Understanding Life Insurance Beneficiary Designations: A Comprehensive Guide

Life insurance beneficiary designations are a crucial aspect of any life insurance policy, ensuring that your loved ones are financially protected in the event of your passing. Although it may seem like a straightforward task, navigating the intricacies of beneficiary designations can be complex and overwhelming.

In this comprehensive guide, we will delve into the intricacies of life insurance beneficiary designations, providing you with a detailed understanding of the process, potential pitfalls, and how to make informed decisions to secure the financial future of your beneficiaries.

What is a Life Insurance Beneficiary Designation?

When you purchase a life insurance policy, you have the opportunity to designate one or multiple beneficiaries who will receive the death benefit upon your passing. A beneficiary is the individual or entity (such as a trust or organization) that you choose to receive the proceeds from your life insurance policy. By designating a beneficiary, you ensure that your loved ones are financially supported and can maintain their standard of living in your absence.

Importance of Beneficiary Designations

Life insurance beneficiary designations are crucial because they provide clear instructions regarding the distribution of your life insurance proceeds. Without a designated beneficiary, the distribution of the death benefit may be subject to delays, disputes, or even unintended consequences.

One of the primary advantages of life insurance beneficiary designations is that the proceeds bypass the probate process. This means that the funds are typically paid directly to the named beneficiaries without being subject to the probate court's oversight. By avoiding probate, your beneficiaries can receive the funds more quickly, allowing them to address immediate financial needs.

Additionally, beneficiary designations provide privacy compared to assets that pass through probate. The probate process is a matter of public record, which means that anyone can access information about your estate, including the assets distributed. By designating beneficiaries, you maintain the confidentiality of your life insurance proceeds, ensuring that the distribution remains private.

Types of Beneficiary Designations

Life insurance policies offer different types of beneficiary designations to accommodate various circumstances and preferences. Understanding the options available can help you tailor your life insurance policy to align with your specific needs.

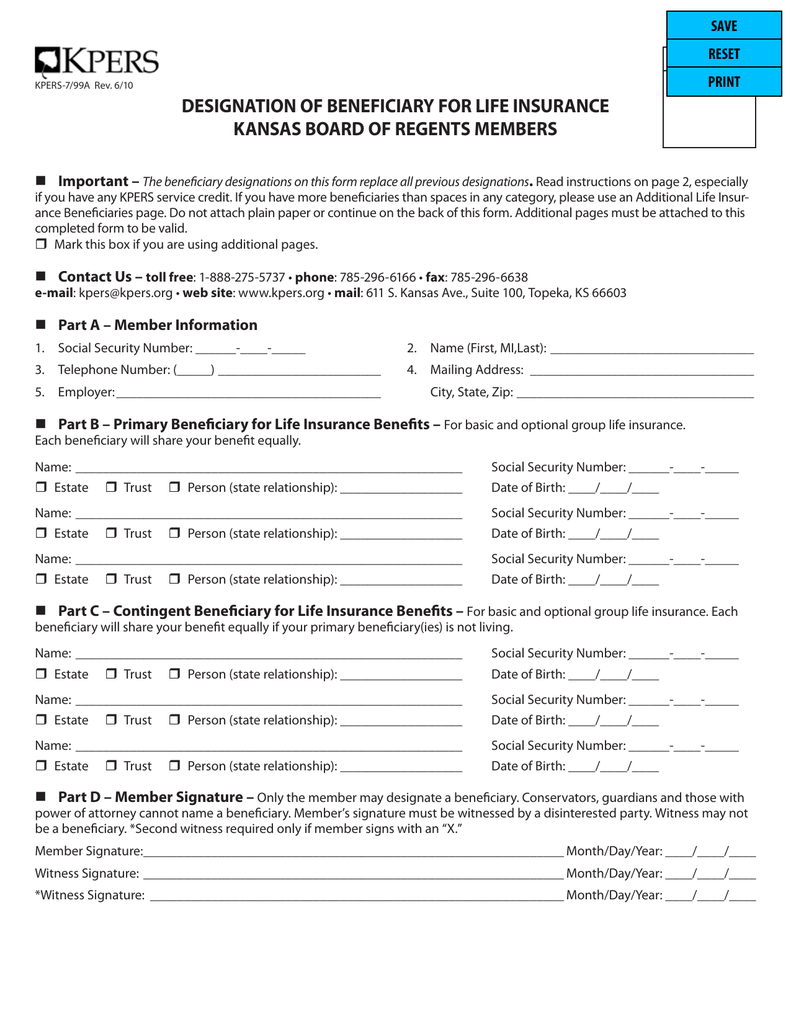

Primary Beneficiaries

Primary beneficiaries are the individuals or entities who are first in line to receive the death benefit. You can designate one or multiple primary beneficiaries, and the policy proceeds are typically divided equally among them. If one of the primary beneficiaries predeceases you or disclaims the benefit, the remaining primary beneficiaries receive a larger share of the death benefit.

Contingent Beneficiaries

Contingent beneficiaries are individuals or entities who receive the death benefit if all the primary beneficiaries have predeceased you or disclaimed the benefit. Including contingent beneficiaries is essential to ensure that there is a backup plan in place if the primary beneficiaries are unable to receive the proceeds.

Revocable and Irrevocable Designations

When designating beneficiaries, you have the option to choose between revocable and irrevocable designations. A revocable designation allows you to change or revoke the beneficiary designation at any time during your lifetime. On the other hand, an irrevocable designation cannot be changed without the consent of the beneficiary. It is important to carefully consider the implications of each type of designation before making a decision.

Designating Multiple Beneficiaries

Designating multiple beneficiaries is a common practice, especially for individuals who want to divide the death benefit among their loved ones. However, it is essential to approach this decision thoughtfully and consider potential implications.

Equal vs. Unequal Distribution

When designating multiple beneficiaries, you have the option to specify how the proceeds should be divided among them. You can choose to distribute the death benefit equally among all beneficiaries or assign specific percentages to each individual. It is crucial to clearly communicate your intentions to avoid misunderstandings or disputes.

Implications for Tax Obligations

Designating multiple beneficiaries can have tax implications for both you and the beneficiaries. In some cases, the division of the death benefit may result in different tax obligations for each beneficiary. It is advisable to consult with a tax professional to understand the potential tax consequences and develop appropriate strategies.

Special Considerations for Minors

If you plan to designate minors as beneficiaries, there are additional considerations to keep in mind. Minors cannot directly receive life insurance proceeds, so you may need to establish a trust or designate a custodian to manage the funds until the minor reaches the age of majority. Naming a responsible adult as the trustee or custodian ensures that the funds are used for the minor's benefit and well-being.

Designating a Trust as Beneficiary

Designating a trust as the beneficiary of your life insurance policy can offer additional control and flexibility over the distribution of the death benefit. However, it is essential to understand the benefits, limitations, and complexities involved in establishing and maintaining a trust.

Asset Protection

One of the primary advantages of designating a trust as your life insurance beneficiary is the potential for enhanced asset protection. By placing the life insurance proceeds in a trust, you can shield them from creditors, lawsuits, and other potential threats. This can be particularly beneficial if you have concerns about the financial stability or responsibility of your beneficiaries.

Distribution Control

Designating a trust allows you to exert control over how and when the life insurance proceeds are distributed to your beneficiaries. You can specify specific conditions or requirements that must be met before the funds are released, such as reaching a certain age, achieving specific milestones, or completing educational programs. This can help ensure that the funds are used responsibly and in line with your wishes.

Complexity and Professional Guidance

Establishing and managing a trust requires a thorough understanding of legal and financial complexities. It is advisable to seek professional guidance from an attorney or estate planning expert to ensure that the trust is properly structured and administered. They can help you navigate the legal requirements and provide valuable insights to ensure the trust aligns with your overall estate planning goals.

Contingent Beneficiaries and Succession Planning

Contingent beneficiaries play a critical role in your overall succession planning. They are the individuals or entities who receive the death benefit if all the primary beneficiaries are unable to do so. Failing to designate contingent beneficiaries can lead to unintended consequences and delays in the distribution of the life insurance proceeds.

Importance of Contingent Beneficiaries

Contingent beneficiaries act as a safety net, ensuring that there is a clear plan in place if the primary beneficiaries are unable to receive the death benefit. Without contingent beneficiaries, the life insurance proceeds may be subject to delays or disputes, potentially leaving your loved ones financially vulnerable during an already challenging time.

Choosing Appropriate Contingent Beneficiaries

When selecting contingent beneficiaries, it is crucial to choose individuals or entities who are likely to outlive the primary beneficiaries. You may also want to consider designating secondary contingent beneficiaries in case the primary contingent beneficiaries are unable to receive the proceeds. This layered approach provides an added level of protection and ensures that your wishes are carried out.

Beneficiary Designations and Divorce

Divorce can significantly impact your life insurance beneficiary designations. Failing to update your beneficiary designations after a divorce can have unintended consequences and may result in assets being distributed contrary to your wishes.

Automatic Revocation Laws

Many states have automatic revocation laws that nullify the designation of a former spouse as a beneficiary upon divorce. However, these laws may not apply to all types of life insurance policies or in every jurisdiction. It is essential to review your policy and consult with an attorney to ensure that your beneficiary designations align with your post-divorce intentions.

Updating Beneficiary Designations

To protect your loved ones and ensure that your life insurance proceeds are distributed according to your wishes, it is crucial to update your beneficiary designations after a divorce. This includes removing your former spouse as a beneficiary and designating new primary and contingent beneficiaries. Regularly reviewing and updating your beneficiary designations is a critical part of maintaining an effective estate plan.

The Role of Estate Planning

Life insurance beneficiary designations are closely intertwined with your overall estate plan. Coordinating these elements can help ensure a seamless transfer of assets and minimize potential conflicts among your beneficiaries.

Alignment with Estate Planning Goals

When establishing your beneficiary designations, it is important to consider how they align with your broader estate planning goals. Your estate plan may include other assets, such as real estate, investment accounts, or retirement funds, which also require careful consideration of beneficiary designations. Coordinating your life insurance beneficiary designations with your overall estate plan helps ensure that your wishes are carried out consistently.

Integration with Trusts and Wills

If you have established a trust or will as part of your estate plan, it is essential to ensure that your beneficiary designations align with these documents. Inconsistencies or conflicts between beneficiary designations and trust or will provisions can lead to confusion, disputes, or legal challenges. Regularly reviewing and updating your estate planning documents in conjunction with your beneficiarydesignations is crucial to maintain a cohesive and effective estate plan.

Professional Guidance

Given the complexities of estate planning and beneficiary designations, it is advisable to seek professional guidance from an attorney or estate planning specialist. They can help you navigate the legal requirements, ensure your documents are properly drafted and executed, and provide valuable insights to help you achieve your estate planning goals.

Tax Implications of Beneficiary Designations

Life insurance beneficiary designations can have tax implications for both you and your beneficiaries. Understanding these implications can help you make informed decisions and develop strategies to minimize potential tax burdens.

Income Tax Considerations

Generally, life insurance death benefits are not subject to income tax. However, if the policy has accumulated cash value or if the death benefit is paid out as installments, there may be taxable income. It is important to consult with a tax professional to understand the specific tax implications of your policy and beneficiary designations.

Estate Tax Considerations

Depending on the size of your estate, your life insurance death benefit may be subject to estate taxes. Estate taxes are calculated based on the total value of your taxable estate, which includes assets such as real estate, investments, and life insurance proceeds. Proper estate planning, including strategic beneficiary designations, can help minimize potential estate tax liabilities.

Gift Tax Considerations

If you transfer ownership of your life insurance policy or make changes to the beneficiary designations as gifts, there may be gift tax implications. The gift tax applies to transfers of property where the fair market value exceeds the annual exclusion limit. Consulting with a tax professional can help you navigate the gift tax rules and ensure compliance with applicable regulations.

Charitable Giving and Tax Benefits

If you wish to make charitable contributions through your life insurance policy, you can designate a charitable organization as a beneficiary. By doing so, you can potentially benefit from tax deductions and contribute to causes that are meaningful to you. Discussing your charitable giving goals with a financial advisor or tax professional can help you maximize the tax benefits of your philanthropic endeavors.

Periodic Review and Updates

Life circumstances change over time, and it is important to regularly review and update your beneficiary designations to ensure they align with your current wishes and circumstances.

Life Events

Life events such as marriage, divorce, the birth of a child, or the death of a loved one can significantly impact your beneficiary designations. It is crucial to review and update your designations to reflect these changes and ensure that your assets are distributed according to your current intentions.

Changing Priorities

As your priorities and relationships evolve, your beneficiary designations may need to be adjusted. For example, if you initially designated a sibling as a beneficiary but now have children, you may want to update your designations to include your children as primary beneficiaries. Regularly assessing and adjusting your beneficiary designations ensures that your assets are distributed in line with your current priorities.

Consultation with Professionals

When reviewing and updating your beneficiary designations, it is beneficial to consult with professionals such as attorneys, financial advisors, and insurance agents. They can provide guidance, ensure that your designations are legally valid and properly executed, and help you consider any implications or consequences of your choices.

In conclusion, understanding life insurance beneficiary designations is vital for any individual seeking to protect their loved ones' financial future. By following this comprehensive guide, you have gained valuable insights into the complexities of beneficiary designations, enabling you to make informed decisions tailored to your unique circumstances. Take control of your life insurance policy today to secure a brighter tomorrow for your beneficiaries.

Posting Komentar untuk "Understanding Life Insurance Beneficiary Designations: A Comprehensive Guide"