Flood Insurance in High-Risk Areas: Protecting Your Property and Peace of Mind

Living in a high-risk flood zone can be a cause for concern for homeowners and renters alike. With unpredictable weather patterns and rising sea levels, the threat of flooding remains a constant worry. However, there is a silver lining amidst the potential devastation: flood insurance. In this comprehensive blog article, we will explore the ins and outs of flood insurance in high-risk areas, providing you with the necessary information to make informed decisions about protecting your property and ensuring peace of mind.

Understanding Flood Zones and Risk Assessment

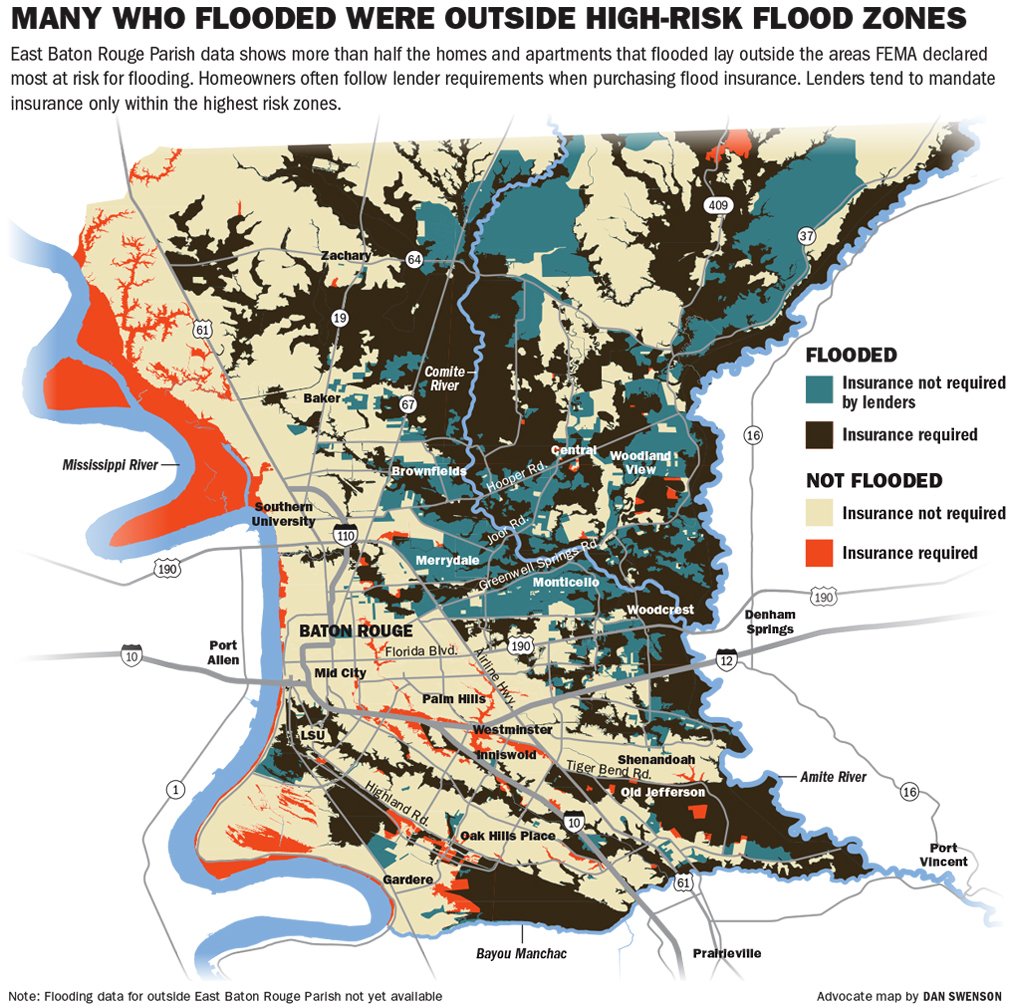

In order to understand the importance of flood insurance in high-risk areas, it is crucial to first comprehend the concept of flood zones and how risk assessment is conducted. Flood zones are geographic areas categorized based on their risk of flooding. These zones are typically determined by analyzing historical flood data, elevation levels, and proximity to bodies of water.

Within the United States, flood zones are commonly designated by the Federal Emergency Management Agency (FEMA). The most high-risk zones are labeled as Special Flood Hazard Areas (SFHAs) or Zone A, Zone AE, or Zone VE. These zones are prone to frequent flooding and require homeowners to obtain flood insurance if they have a mortgage from a federally regulated or insured lender.

How Flood Maps are Created

Flood maps play a vital role in identifying flood-prone areas and assessing their risk levels. These maps are created through a meticulous process that involves analyzing historical flood data, topography, rainfall patterns, and other relevant factors. Using advanced technology and modeling techniques, experts can generate accurate flood maps that serve as valuable tools for homeowners, insurance providers, and local authorities.

Flood maps are periodically updated to account for changes in topography, development, and climate conditions. It is crucial for homeowners to regularly check these maps to stay informed about any changes in their flood risk status. By understanding the flood map for their area, homeowners can take proactive measures to protect their property and ensure they have adequate flood insurance coverage.

Assessing Risk and Determining Premiums

Insurance companies utilize flood maps and various risk assessment factors to determine the premiums for flood insurance in high-risk areas. These factors typically include the property's elevation, construction type, flood zone designation, and proximity to bodies of water.

Properties located in SFHAs or zones with a higher risk of flooding are typically associated with higher premiums. Conversely, properties situated in zones with lower flood risk may have lower insurance premiums. The risk assessment process enables insurance companies to calculate the potential losses a property may incur due to flooding and set appropriate premiums accordingly.

It is important to note that while FEMA establishes the flood zones, individual insurance companies may have their own risk assessment methodologies and factors. Therefore, it is advisable to obtain quotes from multiple insurers and compare their coverage and premiums before making a decision.

The Importance of Flood Insurance

Living in a high-risk flood zone without flood insurance can expose homeowners to significant financial risks. Standard homeowners' insurance policies typically do not cover flood damage, leaving homeowners vulnerable to substantial losses in the event of a flood. Therefore, obtaining flood insurance is crucial for protecting your property and ensuring peace of mind.

Lack of Coverage in Homeowners' Insurance Policies

Standard homeowners' insurance policies are designed to cover perils such as fire, theft, and certain weather-related events, but they typically exclude flood damage. This exclusion means that homeowners without specific flood insurance coverage are responsible for footing the expenses associated with flood-related damages, including structural repairs, content replacement, and temporary living arrangements.

Without flood insurance, homeowners may face financial hardship and struggle to recover from the aftermath of a flood. Therefore, it is imperative to recognize the limitations of homeowners' insurance and take proactive steps to secure adequate coverage.

Financial Protection and Peace of Mind

Flood insurance offers financial protection and peace of mind for homeowners in high-risk areas. By obtaining flood insurance, homeowners transfer the financial risk of flood damage to the insurance provider. In the event of a flood, the insurance policy will cover the costs associated with repairing or rebuilding the property, replacing damaged contents, and potentially providing additional living expenses.

Having flood insurance ensures that homeowners can recover and rebuild their lives without incurring overwhelming financial burdens. It provides reassurance and peace of mind, allowing homeowners to focus on recovering from the emotional and physical impact of a flood.

Types of Flood Insurance Coverage

Flood insurance coverage is designed to protect both the structure of the property and its contents. Understanding the different types of coverage available can help homeowners make informed decisions about their insurance needs in high-risk areas.

Building Property Coverage

Building property coverage, as the name suggests, provides protection for the structure of your property. This type of coverage typically includes the foundation, walls, electrical systems, plumbing, appliances, and permanently installed fixtures. In the event of a flood, building property coverage helps cover the cost of repairing or rebuilding these essential components of your home.

It is important to note that building property coverage does not typically include coverage for detached structures, such as sheds or garages, which may require separate policies or endorsements.

Personal Property Coverage

Personal property coverage is designed to protect the belongings inside your home. This includes furniture, clothing, electronics, appliances, and other personal items. In the event of a flood, personal property coverage helps cover the cost of replacing or repairing damaged or destroyed items.

It is crucial for homeowners to take an inventory of their personal belongings, including photographs or videos, to ensure accurate documentation in case a flood-related claim needs to be filed. Maintaining receipts and proofs of purchase can also assist in the claims process.

Contents Coverage

Contents coverage is similar to personal property coverage but specifically focuses on the contents of your property that are not permanently installed. This includes items such as furniture, electronics, clothing, and appliances. Contents coverage can be particularly valuable for renters, as it protects their belongings without the need for building property coverage.

It is important to review the coverage limits and exclusions of your flood insurance policy to ensure that high-value items are adequately protected. Some policies may have limitations on coverage for certain types of belongings, such as jewelry or artwork, and additional coverage may be necessary.

Determining the Cost of Flood Insurance

The cost of flood insurance premiums can vary depending on several factors. Understanding these factors can help homeowners assess the potential costs and take appropriate steps to manage their insurance expenses.

Flood Zone Designation

The flood zone designation of your property is a significant factor influencing the cost of flood insurance. Higher-risk zones, such as SFHAs, typically have higher premiums due to the increased likelihood of flooding. Conversely, properties located in lower-risk zones may have lower premiums.

It is important to note that flood maps can change over time, and properties may be reclassified into different flood zones. Therefore, homeowners should regularly review their flood zone status and adjust their insurance coverage accordingly.

Elevation of the Property

The elevation of your property relative to the base flood elevation (BFE) can impact flood insurance premiums. Properties situated at lower elevations are at a higher risk of flood damage and, therefore, may have higher premiums. Conversely, properties located at higher elevations may qualify for lower premiums as they are less susceptible to flooding.

Homeowners in high-risk areas can consider taking measures to elevate their properties, such as installing flood vents or raising the foundation, to potentially reduce their flood insurance premiums. However, it is crucial to consult with experts and ensure that any modifications comply with local building codes and regulations.

Construction Type and Materials

The construction type and materials used in your property can also influence flood insurance premiums. Certain construction types, such as elevated homes or those built with flood-resistant materials, may qualify for lower premiums due to their reduced susceptibility to flood damage.

Insurance providers consider factors such as the foundation type, building materials, and resistance to floodwaters when determining premiums. Homeowners can consult with professionals to explore potential retrofitting options or building improvements that may help reduce insurance costs.

Proximity to Bodies of Water

The proximity of your property to bodies of water, such as rivers, lakes, or oceans, can impact flood insurance premiums. Properties located closer to water sources may be at a higher risk of flooding and, therefore, may have higher premiums.

It is essential for homeowners to consider the potential risks associated with their proximity to bodies of water when assessing their flood insurance needs. Factors such as historical flood data, storm surge risks, and local drainage systems should be taken into account.

Insurance Company and Coverage Limits

Insurance companies may have different pricing structures and coverage options for flood insurance. It is advisable to obtain quotes from multiple insurers and compare the coverage and premiums offered. Additionally, homeowners should carefully review the policy's coverage limits to ensure they align with their needs and property value.

While cost is an important consideration, it should not be the sole determining factor when selecting flood insurance coverage. It is crucial to strike a balance between affordability and adequate coverage to ensure comprehensive protection.

National Flood Insurance Program (NFIP) vs. Private Insurance

When seeking flood insurance in high-risk areas, homeowners have the option to choosebetween obtaining coverage through the National Flood Insurance Program (NFIP) or private insurance companies. Each option has its own advantages and considerations that homeowners should be aware of before making a decision.

National Flood Insurance Program (NFIP)

The NFIP is a federal program administered by FEMA that offers flood insurance coverage to homeowners, renters, and businesses in participating communities. One of the key advantages of the NFIP is that it provides coverage in areas where private insurance companies may be hesitant to offer policies due to the high flood risk.

Some benefits of obtaining flood insurance through the NFIP include standardized coverage, set policy limits, and the ability to file claims directly with the government. The program also offers options for both building property and personal property coverage, as well as content coverage for renters.

However, it is important to note that NFIP policies may have limitations and exclusions, and coverage may not always be sufficient to fully cover all flood-related losses. Additionally, the NFIP has certain restrictions on coverage amounts, and rates may increase over time.

Private Insurance Companies

Private insurance companies also offer flood insurance coverage in high-risk areas. These companies may provide more flexibility in terms of coverage options and policy limits, allowing homeowners to customize their policies to better suit their needs.

One advantage of private insurance is that it may offer higher coverage limits than NFIP policies, which can be particularly beneficial for homeowners with high-value properties. Private insurers may also offer additional policy features, such as coverage for additional living expenses or specialized coverage for valuable items.

However, it is important to carefully review the terms and conditions of private insurance policies, as they can vary significantly between insurers. Homeowners should ensure that the private insurance policy meets their specific needs and provides adequate coverage for their property and belongings.

It is worth noting that private insurance policies may come with higher premiums than NFIP policies, especially in high-risk areas. Homeowners should carefully consider the cost-benefit analysis of private insurance coverage, taking into account their specific risk profile and coverage requirements.

Filing a Flood Insurance Claim

In the unfortunate event of a flood, filing a flood insurance claim is a crucial step towards recovering and rebuilding. Understanding the process and having the necessary documentation can help expedite the claims process and ensure a smoother experience.

Step 1: Documenting the Damage

As soon as it is safe to do so, homeowners should document the flood damage by taking photographs or videos. This visual evidence will be essential when filing a claim and can help substantiate the extent of the damage to the insurance provider.

It is recommended to thoroughly document all affected areas of the property, including structural damage, damaged belongings, and any other visible signs of flood-related damage.

Step 2: Contacting the Insurance Provider

Once the damage has been documented, homeowners should promptly contact their flood insurance provider to initiate the claims process. The insurance provider will guide them through the necessary steps and provide instructions on how to proceed.

When contacting the insurance provider, homeowners should have their policy information readily available, including the policy number and effective dates. This will facilitate the claims process and ensure accurate information is provided.

Step 3: Filing the Claims Form

Homeowners will be required to complete a claims form provided by the insurance company. This form will require detailed information about the property, the extent of the damage, and a list of damaged or destroyed belongings.

It is crucial to be thorough and accurate when filling out the claims form. Providing as much detail as possible will help ensure that all eligible damages are properly accounted for.

Step 4: Documenting Expenses

During the claims process, homeowners should keep a record of all expenses incurred as a result of the flood, such as temporary accommodations, meals, and transportation costs. These expenses may be eligible for coverage under additional living expenses (ALE) if the policy includes this provision.

Keeping receipts and detailed records of all expenses will facilitate the reimbursement process and help homeowners recover the costs associated with living arrangements during the repair or rebuilding period.

Step 5: Meeting with Adjusters

After filing the claim, an insurance adjuster will be assigned to assess the damages and determine the coverage amount. The adjuster will schedule a visit to the property to inspect the damage and gather information.

During the meeting with the adjuster, homeowners should provide any additional documentation or evidence of the damages. It can be helpful to have the initial documentation of the damage, as well as any repair estimates or contractor assessments, available for reference.

Step 6: Reviewing the Settlement Offer

Once the adjuster has completed the assessment, the insurance company will provide a settlement offer outlining the coverage amounts for repairs or replacement of damaged property and belongings.

Homeowners should thoroughly review the settlement offer, ensuring that it accurately reflects the damages and that the coverage amounts are fair. If there are any discrepancies or concerns, homeowners should contact their insurance provider to discuss and seek clarification.

Step 7: Rebuilding and Repairs

Once the settlement offer has been accepted, homeowners can proceed with repairs or rebuilding. It is crucial to work with reputable contractors and ensure that all necessary permits and regulations are adhered to.

Homeowners should maintain open communication with their insurance provider throughout the repair process and keep them informed of any significant developments or changes in the scope of work.

Mitigation and Prevention Measures

While flood insurance provides financial protection, homeowners in high-risk areas can take proactive measures to mitigate the risk of flood damage. Implementing both structural and non-structural solutions can help reduce potential losses and increase the resilience of the property.

Structural Solutions

Structural solutions involve physical modifications to the property to reduce the impact of flooding. These measures can include elevating the property, installing flood vents, reinforcing walls and foundations, and utilizing flood-resistant materials.

Consulting with professionals, such as architects, engineers, or flood mitigation specialists, can help homeowners identify the most effective structural solutions for their specific property and flood risk profile.

Non-Structural Solutions

Non-structural solutions focus on strategies that do not involve physical modifications to the property but instead aim to minimize the impact of flooding. These measures can include creating designated flood storage areas, implementing flood warning systems, and establishing emergency response plans.

Homeowners can also take steps to improve the property's drainage systems, such as regularly maintaining gutters and downspouts, redirecting water away from the foundation, and ensuring proper grading.

Community-Level Mitigation

Community-level mitigation efforts can also contribute to reducing flood risks in high-risk areas. These initiatives can include implementing floodplain management regulations, improving local drainage systems, and enhancing emergency response capabilities.

Homeowners can participate in community discussions and engage with local authorities to advocate for effective flood mitigation measures. By working together, communities can create a more resilient environment and reduce the potential impact of flooding.

Government Assistance Programs

In addition to flood insurance, homeowners in high-risk areas may be eligible for various government assistance programs that provide financial support for flood-related damages and mitigation efforts.

Federal Disaster Assistance

In the event of a federally declared disaster, homeowners may be eligible for federal disaster assistance through programs such as the Individual Assistance Program (IA) and the Hazard Mitigation Grant Program (HMGP).

The IA program provides financial assistance to individuals and households affected by a disaster, including funds for temporary housing, home repairs, and other disaster-related expenses. The HMGP offers grants to support long-term mitigation measures aimed at reducing the risk and impact of future disasters.

Community Development Block Grants

The Community Development Block Grant (CDBG) program provides funding to state and local governments to support a wide range of community development activities, including disaster recovery and mitigation efforts.

Homeowners in high-risk areas can explore opportunities to access CDBG funds for flood mitigation projects, such as elevating properties, improving drainage systems, or implementing community-wide flood prevention initiatives.

State-Specific Assistance Programs

Some states may offer their own assistance programs to homeowners in high-risk flood areas. These programs can provide grants or low-interest loans for flood mitigation projects, home repairs, or insurance premium subsidies.

Homeowners should research and reach out to their respective state agencies or departments responsible for emergency management or housing to inquire about any available assistance programs specific to their location.

The Role of Insurance Agents and Experts

When navigating flood insurance in high-risk areas, consulting with insurance agents and experts can provide valuable insights and guidance tailored to individual circumstances. These professionals can help homeowners understand their coverage options, assess their risk profiles, and make informed decisions.

Insurance Agents

Insurance agents specialize in understanding the intricacies of flood insurance policies and can help homeowners navigate the complexities of obtaining coverage. They can provide advice on policy options, coverage limits, and premium costs.

When selecting an insurance agent, homeowners should seek out those with expertise in flood insurance and a strong understanding of the specific risks associated with their high-risk flood area.

Flood Mitigation Specialists

Flood mitigation specialists are professionals who specialize in assessing and mitigating flood risks. These experts can conduct detailed evaluations of properties and provide recommendations for flood prevention and mitigation measures.

Working with a flood mitigation specialist can help homeowners identify the most effective strategies to reduce the risk of flood damage. They can provide insights on both structural and non-structural solutions, taking into account the specific characteristics of the property and the surrounding environment.

Public Adjusters

In the event of a flood, homeowners may encounter challenges when filing a flood insurance claim or negotiating with insurance companies. Public adjusters can assist homeowners in navigating the claims process, ensuring that they receive fair and accurate compensation for their losses.

Public adjusters are independent professionals who work on behalf of policyholders, advocating for their best interests during the claims process. They can assess the damage, document losses, and negotiate with the insurance company to ensure a fair settlement.

Frequently Asked Questions

When it comes to flood insurance in high-risk areas, homeowners often have numerous questions and concerns. Addressing common queries can help homeowners gain a better understanding of flood insurance and make more informed decisions.

1. Can I purchase flood insurance if I am not in a designated flood zone?

Yes, flood insurance is available to homeowners outside of designated flood zones. While the risk may be lower, it is still advisable to consider obtaining coverage, as floods can occur in unexpected areas.

2. Do I need flood insurance if my property is elevated?

Even if your property is elevated, it is still recommended to consider flood insurance. Flooding can occur due to heavy rainfall, storm surges, or other factors, and it is better to be prepared and protected.

3. Will my flood insurance cover all types of floods?

Flood insurance typically covers a wide range of flooding events, including river floods, coastal floods, flash floods, and more. However, it is important to review your policy and understand any specific exclusions or limitations.

4. Can I purchase flood insurance after a flood occurs?

In most cases, there is a waiting period before flood insurance coverage takes effect. It is advisable to obtain flood insurance well in advance to ensure you are adequately protected.

5. Can I cancel my flood insurance policy if I no longer want coverage?

Homeowners have the option to cancel their flood insurance policy at any time. However, it is important to carefully consider the potential risks and financial consequences before making a decision.

6. Can I transfer my flood insurance policy to a new owner if I sell my property?

Flood insurance policies are generally not transferable to new owners. The new owner will need to obtain their own flood insurance policy for the property.

7. How can I determine the coverage limits for my flood insurance policy?

The coverage limits for your flood insurance policy should be based on the estimated rebuilding cost of your property and the value of your belongings. It is advisable to consult with your insurance agent or a professional appraiser to determine appropriate coverage limits.

8. Are there any discounts or incentives available for flood insurance in high-risk areas?

Some insurance companies and government programs may offer discounts or incentives for flood mitigation measures, such as elevating your property or installing flood-resistant features. It is recommended to inquire with your insurance provider and local authorities for any available discounts or incentives.

9. Can I make changes to my flood insurance policy after it is issued?

Yes, you can make changes to your flood insurance policy after it is issued. However, certain changes may be subject to a waiting period or additional underwriting requirements. It is best to consult with your insurance agent to understand the process and any potential implications.

10. How often should I review and update my flood insurance policy?

It is recommended to review and update your flood insurance policy annually, or whenever there are significant changes to your property, such as renovations or additions. It is also important to review your policy if there are updates to flood maps or changes in your flood risk designation.

By understanding the ins and outs of flood insurance in high-risk areas, homeowners can make informed decisions to protect their property and find peace of mind amidst the unpredictable forces of nature. Consultation with insurance experts, proactive mitigation measures, and thorough documentation can all contribute to ensuring comprehensive coverage and effective recovery in the event of a flood.

Posting Komentar untuk "Flood Insurance in High-Risk Areas: Protecting Your Property and Peace of Mind"