Dental Insurance that Covers Orthodontics: Everything You Need to Know

Are you considering getting orthodontic treatment to achieve that perfect smile? If so, it's crucial to understand how dental insurance can help cover the costs associated with orthodontic procedures. In this comprehensive guide, we will walk you through everything you need to know about dental insurance that covers orthodontics, ensuring you make informed decisions about your oral health and finances.

Orthodontic treatment, such as braces or aligners, can be a life-changing investment. However, it often comes with a hefty price tag. That's where dental insurance plays a vital role. While not all dental insurance plans cover orthodontics, those that do can significantly reduce your out-of-pocket expenses, making it more affordable to achieve your dream smile.

Understanding Dental Insurance Coverage for Orthodontics

When it comes to dental insurance coverage for orthodontics, it's important to have a clear understanding of the terms and conditions involved. These terms can include waiting periods, deductibles, and annual maximums. Let's delve into each of these factors to help you navigate the complexities of dental insurance policies.

1. Waiting Periods

Many dental insurance plans have waiting periods before orthodontic coverage kicks in. These waiting periods can range from a few months to a year. During this waiting period, you may not be eligible for orthodontic benefits. It's crucial to know the waiting period associated with your insurance plan to plan your treatment timeline accordingly.

2. Deductibles

Dental insurance plans often have a deductible, which is the amount you must pay out-of-pocket before your insurance coverage begins. Deductibles can vary depending on your plan, and they usually reset annually. Understanding your deductible is essential to budgeting for your orthodontic treatment.

3. Annual Maximums

An annual maximum is the maximum amount your dental insurance plan will pay for orthodontic treatment within a year. Once you reach this limit, you will be responsible for any additional costs. It's crucial to be aware of your plan's annual maximum to plan your treatment and budget effectively.

By understanding waiting periods, deductibles, and annual maximums, you can make informed decisions about your orthodontic treatment and effectively utilize your dental insurance coverage.

Types of Dental Insurance Plans that Cover Orthodontics

Not all dental insurance plans provide coverage for orthodontics. It's essential to explore the different types of dental insurance plans that offer orthodontic coverage to determine the best option for your needs.

1. Employer-Sponsored Plans

Many employers offer dental insurance plans as part of their benefits package. Some of these plans may include orthodontic coverage. If you have access to an employer-sponsored dental insurance plan, it's worth checking the details to see if orthodontics are covered.

2. Individual Dental Insurance Plans

If you don't have access to an employer-sponsored plan, you can explore individual dental insurance plans. These plans are purchased independently and offer varying levels of coverage for orthodontic treatment. It's important to compare different individual plans to find one that meets your specific orthodontic needs.

3. Supplemental Orthodontic Insurance

In some cases, you may have a dental insurance plan that does not include orthodontic coverage. In such situations, you can consider supplemental orthodontic insurance. These plans specifically cover orthodontic treatment and can be added to your existing dental insurance plan.

By understanding the different types of dental insurance plans that cover orthodontics, you can choose the one that aligns with your needs and budget.

What Orthodontic Procedures Does Dental Insurance Typically Cover?

Orthodontic treatment encompasses various procedures, and dental insurance plans typically cover certain treatments. It's important to be aware of the procedures covered by your insurance plan and any limitations or exclusions that may apply.

1. Traditional Metal Braces

Traditional metal braces are a common orthodontic treatment, and many dental insurance plans cover them. These braces consist of metal brackets and wires and are effective in straightening teeth and correcting bite issues.

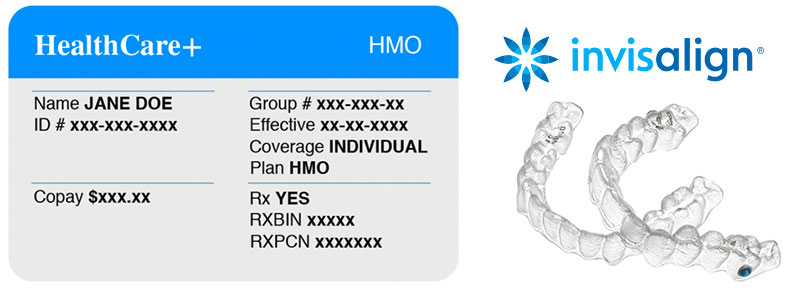

2. Clear Aligners

Clear aligners, such as Invisalign, have gained popularity due to their discreet appearance and removability. Some dental insurance plans may offer coverage for clear aligners, although the extent of coverage may vary. It's important to check with your insurance provider to determine if clear aligners are covered.

3. Retainers

After completing orthodontic treatment, retainers are often necessary to maintain the results. Some dental insurance plans may cover a portion of the cost of retainers. It's important to understand the coverage for retainers to ensure you can maintain your newly aligned smile.

4. Jaw Corrective Surgeries

In some cases, orthodontic treatment may involve jaw corrective surgeries to address severe bite issues or alignment problems. Dental insurance plans may provide coverage for these surgical procedures, but it's important to check the specific details of your plan.

5. Other Orthodontic Appliances

Aside from braces, aligners, retainers, and jaw surgeries, there are other orthodontic appliances that may be covered by dental insurance plans. These can include expanders, headgear, and more. It's essential to review your plan's coverage to understand the scope of appliances included.

By knowing which orthodontic procedures are typically covered by dental insurance, you can better plan your treatment and manage your financial obligations.

How to Choose the Right Dental Insurance Plan for Orthodontics

With numerous dental insurance plans available, choosing the right one for your orthodontic needs can be overwhelming. To make an informed decision, consider the following factors when comparing different dental insurance plans that cover orthodontics:

1. Orthodontic Coverage Details

Review the coverage details of each plan, including waiting periods, deductibles, and annual maximums. Assess how these factors align with your orthodontic treatment timeline and financial capabilities.

2. In-Network Orthodontists

Check if the dental insurance plan has a network of orthodontists in your area. Orthodontic treatments often require regular visits, so having a convenient and accessible network of orthodontists is important.

3. Coverage for Pre-Existing Conditions

If you or your dependents require orthodontic treatment for pre-existing conditions, ensure that the dental insurance plan covers such circumstances. Some plans may have exclusions or waiting periods for pre-existing conditions.

4. Cost of Premiums

Consider the cost of monthly premiums for each dental insurance plan. Ensure that the premium amount is reasonable and fits within your budget, considering both the orthodontic coverage and other dental benefits included in the plan.

5. Additional Dental Benefits

Alongside orthodontic coverage, dental insurance plans often include other dental benefits, such as preventive care, cleanings, and fillings. Evaluate the additional benefits and ensure they align with your overall dental needs.

6. Customer Reviews and Ratings

Research customer reviews and ratings for different dental insurance plans. Feedback from current or previous policyholders can provide insights into the plan's reliability, customer service, and overall satisfaction.

By considering these factors, you can choose a dental insurance plan that provides adequate coverage for your orthodontic needs while fitting within your budget and preferences.

Waiting Periods and Orthodontic Coverage

Waiting periods are an essential aspect of dental insurance coverage for orthodontics. Understanding waiting periods is crucial for planning your orthodontic treatment timeline and managing your expectations.

1. What Are Waiting Periods?

Waiting periods are predetermined periods of time that you must wait before becoming eligible for specific orthodontic benefits. Insurance providers impose waiting periods to prevent individuals from signing up for coverage solely to receive immediate orthodontic treatment.

2. Waiting Period Lengths

The length of waiting periods can vary depending on the dental insurance plan. Some plans may have waiting periods as short as a few months, while others may require waiting periods of a year or longer. It's important to review your plan's waiting period details to plan your orthodontic treatment accordingly.

3. Exceptions to Waiting Periods

While waiting periods are common, certain exceptions may apply. For example, some dental insurance plans may waive the waiting period if you had previous orthodontic coverage before switching plans. It's crucial to review your plan's policy to see if any exceptions apply to your situation.

4. Planning Around Waiting Periods

If you're aware of the waiting period associated with your dental insurance plan, you can plan your orthodontic treatment timeline accordingly. This includes scheduling consultations, preliminary examinations, and any necessary preparatory procedures before the waiting period ends.

5. Utilizing Waiting Periods

Although waiting periods can be frustrating, they can also provide an opportunity to prepare for your orthodontic treatment.

5. Utilizing Waiting Periods (continued)

During the waiting period, you can research orthodontists in your network, gather information about different treatment options, and develop a comprehensive plan for your orthodontic journey. This preparation can help you make informed decisions and maximize the effectiveness of your treatment once the waiting period expires.

By understanding waiting periods and effectively utilizing them, you can navigate the process more smoothly and make the most of your dental insurance coverage for orthodontics.

The Role of Orthodontic Pre-authorization

Orthodontic pre-authorization is a crucial step in ensuring that your dental insurance covers the cost of your orthodontic treatment. It involves obtaining approval from your insurance provider before starting your orthodontic journey. Let's explore the role of orthodontic pre-authorization and the steps involved:

1. Why is Orthodontic Pre-authorization Necessary?

Orthodontic pre-authorization is necessary to confirm that your dental insurance plan covers the specific orthodontic treatment you are considering. It helps you understand the level of coverage and any out-of-pocket expenses you may incur.

2. Gathering Documentation and Information

When seeking orthodontic pre-authorization, you will need to gather relevant documentation and information. This may include orthodontic treatment plans, X-rays, photographs, and any other supporting documents requested by your insurance provider.

3. Submitting the Pre-authorization Request

Once you have the necessary documentation, you can submit the pre-authorization request to your dental insurance provider. This can usually be done online or through a designated portal. Be sure to provide all requested information accurately and completely to avoid delays in the process.

4. Waiting for Approval

After submitting the pre-authorization request, you will need to wait for approval from your insurance provider. The approval process can take several weeks, so it's important to plan your orthodontic treatment timeline accordingly.

5. Reviewing the Pre-authorization Response

Once you receive a response from your insurance provider, carefully review the details of the pre-authorization. Pay attention to the approved treatment duration, coverage percentage, and any out-of-pocket expenses you may be responsible for.

6. Understanding Limitations and Exclusions

While pre-authorization provides a clear picture of your coverage, it's important to understand any limitations or exclusions that may apply. Some dental insurance plans may have specific criteria or age limits for orthodontic coverage, so be sure to review the fine print.

By following the steps of orthodontic pre-authorization, you can ensure that your dental insurance covers the cost of your orthodontic treatment and avoid any surprises or unnecessary expenses.

Tips for Maximizing Orthodontic Insurance Benefits

Orthodontic insurance benefits can be maximized by understanding your coverage and making informed decisions. Here are some valuable tips to help you make the most of your orthodontic insurance benefits:

1. Review Your Coverage Details

Thoroughly review your dental insurance plan's coverage details for orthodontics. Understand the percentage of coverage provided, any deductibles or co-pays, and the annual maximum. This knowledge will help you plan your treatment and budget effectively.

2. Utilize Flexible Spending Accounts

If your employer offers a flexible spending account (FSA) or health savings account (HSA), consider utilizing these funds for orthodontic expenses. These accounts allow you to set aside pre-tax dollars, reducing your overall out-of-pocket costs.

3. Coordinate with Your Orthodontist

Work closely with your orthodontist to maximize your insurance benefits. They can help you navigate the insurance process, provide accurate cost estimates, and suggest treatment options that align with your coverage.

4. Optimize Timing of Treatment

Timing your orthodontic treatment strategically can help you maximize your insurance benefits. For example, if your plan has an annual maximum, starting treatment at the beginning of the year allows you to utilize the full coverage amount.

5. Keep Up with Oral Hygiene

Maintaining excellent oral hygiene throughout your orthodontic treatment is essential. This helps prevent any complications that may require additional dental procedures, which may not be fully covered by insurance.

6. Follow Your Orthodontist's Recommendations

Adhering to your orthodontist's treatment plan and recommendations is crucial. Deviating from the prescribed plan may result in additional costs or complications that are not covered by your insurance.

7. Keep Track of Expenses

Keep detailed records of all orthodontic-related expenses, including receipts and statements. This documentation will be useful when filing claims and ensuring you receive the appropriate insurance reimbursements.

8. Stay Informed About Policy Changes

Insurance policies may change over time, so it's important to stay informed about any updates or modifications to your coverage. Regularly review your policy and communicate with your insurance provider to ensure you have the most up-to-date information.

9. Consider Orthodontic Membership Plans

If you do not have dental insurance that covers orthodontics, consider exploring orthodontic membership plans. These plans, offered by some orthodontic practices, provide discounted rates and payment plans specifically for orthodontic treatment.

10. Seek Clarification from Your Insurance Provider

If you have any doubts or questions about your orthodontic insurance coverage, don't hesitate to contact your insurance provider directly. Seeking clarification ensures that you are well-informed and can make decisions based on accurate information.

By following these tips, you can optimize your orthodontic insurance benefits and minimize your out-of-pocket expenses throughout your treatment journey.

Common Orthodontic Insurance Billing and Reimbursement Practices

Orthodontic insurance billing and reimbursement can sometimes be complex. Understanding common billing practices and reimbursement procedures can help you navigate the process more effectively. Let's explore some aspects of orthodontic insurance billing and reimbursement:

1. Orthodontic Treatment Codes

Orthodontic treatment is categorized using specific codes that facilitate billing and reimbursement processes. Common codes include those for initial consultations, X-rays, braces, retainers, and other orthodontic procedures. Familiarize yourself with these codes to better understand the breakdown of charges on your insurance statements.

2. Coordination of Benefits (COB)

If you have multiple insurance policies that cover orthodontics, coordination of benefits may be necessary. COB determines which insurance plan is primary and which is secondary. Understanding how COB works helps ensure that claims are processed correctly and that you receive the maximum benefits available.

3. Assignment of Benefits

When you assign benefits to your orthodontist, it means that the insurance reimbursement is directly paid to the orthodontic practice. This can simplify the billing process for you and prevent any delays or complications in receiving your reimbursements.

4. Explanation of Benefits (EOB)

An Explanation of Benefits is a statement provided by your insurance company that breaks down how claims were processed and the benefits paid. Review your EOBs carefully to ensure accuracy and understand the coverage provided for each procedure.

5. Out-of-Network Coverage

If you receive orthodontic treatment from an out-of-network provider, the coverage and reimbursement rates may differ. It's important to understand the implications of out-of-network coverage and to discuss potential costs and reimbursements with your insurance provider in advance.

6. Filing Claims and Required Documentation

When filing orthodontic insurance claims, it's crucial to provide all necessary documentation. This may include treatment plans, progress reports, X-rays, and other supporting documents requested by your insurance provider. Submitting complete and accurate documentation helps expedite the reimbursement process.

7. Reimbursement Timelines

Reimbursement timelines can vary depending on your insurance provider and the complexity of your treatment. Some insurance companies may reimburse you directly, while others may reimburse the orthodontic practice. Familiarize yourself with your insurance company's reimbursement policies to manage your expectations accordingly.

8. Appealing Denied Claims

If a claim is denied by your insurance provider, you have the right to appeal the decision. Understanding the appeal process and providing additional documentation or supporting evidence can increase the chances of a successful appeal. Consult with your orthodontist or insurance provider for guidance on the appeals process.

By familiarizing yourself with these common orthodontic insurance billing and reimbursement practices, you can navigate the process more confidently and ensure that you receive the appropriate reimbursements for your orthodontic treatment.

Orthodontic Insurance FAQs

Throughout this guide, you may have questions specific to your situation. Here are answers to some frequently asked questions about dental insurance that covers orthodontics:

1. Does Dental Insurance Cover Cosmetic Orthodontic Procedures?

Orthodontic procedures that solely address cosmetic concerns, such as minor tooth movement, may not be covered by dental insurance.

1. Does Dental Insurance Cover Cosmetic Orthodontic Procedures? (continued)

Insurance coverage for orthodontic procedures typically focuses on treatments that address functional or medically necessary concerns. However, it's best to check with your insurance provider to determine their specific coverage policies regarding cosmetic orthodontic procedures.

2. Can I Get Orthodontic Coverage if I Already Have Braces?

If you already have braces and are considering switching dental insurance plans or adding orthodontic coverage to your existing plan, coverage for your ongoing treatment may vary. Some plans may provide coverage for the remaining duration of your treatment, while others may have limitations or waiting periods. It's important to review the policy details and consult with your insurance provider for clarification.

3. Is Orthodontic Treatment Covered for Adults?

Orthodontic coverage for adults varies among dental insurance plans. While some plans offer orthodontic benefits for adults, others may have age restrictions or exclusions. Review your plan's policy or contact your insurance provider to determine the coverage available for adult orthodontic treatment.

4. Does Dental Insurance Cover Invisalign?

Coverage for Invisalign or other clear aligner systems depends on your dental insurance plan. Some plans provide coverage for clear aligners, while others may have specific limitations or requirements. It's important to review your plan's policy or contact your insurance provider to understand the coverage for clear aligners.

5. Can I Use Dental Insurance for Orthodontic Retainers?

Dental insurance plans may cover a portion of the cost of orthodontic retainers. Retainers are considered a crucial part of orthodontic treatment to maintain the results achieved with braces or aligners. However, coverage may vary, so it's advisable to review your specific plan details to determine the extent of coverage for retainers.

6. How Can I Determine the Out-of-Pocket Costs for Orthodontic Treatment?

To determine the out-of-pocket costs for your orthodontic treatment, review your dental insurance plan's coverage details. Take into account any deductibles, co-pays, and percentage of coverage provided. Additionally, consider the annual maximum and whether it has been met or if it will reset during your treatment. Consulting with your orthodontist and insurance provider can also help estimate the anticipated costs.

7. Can I Have Orthodontic Coverage Without Waiting Periods?

Some dental insurance plans may offer orthodontic coverage without waiting periods. However, these plans may have other limitations or higher premiums. It's important to carefully review the policy details and compare different plans to find one that suits your specific needs and preferences.

8. Does Orthodontic Insurance Cover Two-Phase Treatment?

Two-phase orthodontic treatment involves addressing orthodontic issues in two stages, typically during childhood and adolescence. Coverage for two-phase treatment can vary among dental insurance plans. Some plans may cover both phases, while others may provide coverage for the second phase only. Review your specific plan details or consult with your insurance provider to determine the coverage available for two-phase treatment.

9. Can I Get Orthodontic Coverage for my Child?

Dental insurance plans often offer orthodontic coverage for dependent children. However, coverage may vary depending on the specific plan and the child's age. Some plans have age limitations, while others may require documentation of a functional or medical need for orthodontic treatment. Review your plan's policy or contact your insurance provider for details on orthodontic coverage for your child.

10. What Happens if I Change Jobs or Insurance Plans During Orthodontic Treatment?

If you change jobs or insurance plans during orthodontic treatment, it's essential to review the new plan's orthodontic coverage. Depending on the circumstances, you may be able to continue treatment with your current orthodontist under the new plan or switch to an in-network provider. Contact your insurance provider and orthodontist to discuss the options available to you.

Remember that specific coverage details and policies can vary among dental insurance plans. It's always recommended to review your plan's policy documents and consult with your insurance provider for accurate and up-to-date information regarding orthodontic coverage.

Alternatives to Dental Insurance for Orthodontic Coverage

If you do not have dental insurance that covers orthodontics or your current plan does not provide sufficient coverage, there are alternative options to consider. These alternatives can help you finance your orthodontic treatment and make it more affordable. Here are some options to explore:

1. Dental Discount Plans

Dental discount plans, also known as dental savings plans, offer discounted rates for various dental treatments, including orthodontics. These plans involve paying an annual fee to access reduced prices for services provided by participating dentists and orthodontists. While not insurance, dental discount plans can help lower the overall cost of orthodontic treatment.

2. Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs)

If your employer offers a health savings account (HSA) or flexible spending account (FSA), you can utilize these funds to cover orthodontic expenses. HSAs and FSAs allow you to set aside pre-tax dollars from your paycheck to use toward eligible medical expenses, including orthodontic treatment.

3. Orthodontic Financing Plans

Many orthodontic practices offer financing plans specifically designed to make treatment more affordable. These plans often involve setting up monthly payment arrangements with little or no interest. Speak with your orthodontist to explore the financing options they offer.

4. Orthodontic Scholarships or Grants

There are various charitable organizations and foundations that offer scholarships or grants for orthodontic treatment. These programs aim to provide financial assistance to individuals who may not have access to insurance coverage or the means to afford orthodontic care. Research and reach out to such organizations to inquire about available opportunities.

5. Negotiating Payment Plans with Orthodontists

Some orthodontic practices may be open to negotiating payment plans or offering discounted rates for patients without insurance coverage. It's worth discussing your financial situation with your orthodontist to explore potential options for making treatment more affordable.

When considering these alternatives to dental insurance, it's important to carefully assess the terms, costs, and eligibility criteria associated with each option. Consult with your orthodontist and financial advisors to determine the best approach for financing your orthodontic treatment.

In conclusion, dental insurance that covers orthodontics can significantly reduce the financial burden of orthodontic treatment. By understanding the coverage details, types of plans available, and maximizing your insurance benefits, you can make informed decisions and embark on your orthodontic journey with confidence. Additionally, exploring alternative financing options can provide additional avenues for making orthodontic treatment more affordable. Remember to review the specific details of your dental insurance plan, consult with your orthodontist and insurance provider, and explore options that best suit your needs and budget. With the right knowledge and resources, you can achieve a beautiful, healthy smile while effectively managing your finances.

Posting Komentar untuk "Dental Insurance that Covers Orthodontics: Everything You Need to Know"