Understanding Supplemental Insurance Plans for Medicare: A Comprehensive Guide

Are you nearing retirement age or already enrolled in Medicare? If so, you may have heard about supplemental insurance plans, also known as Medigap policies, that can help cover the gaps in your Medicare coverage. With the ever-increasing healthcare costs, having a comprehensive understanding of these plans is crucial for ensuring your financial well-being during your golden years. In this article, we will delve into the intricacies of supplemental insurance plans for Medicare, exploring their benefits, coverage options, and how to choose the right plan for your needs.

First and foremost, it's important to grasp the basics. Medicare, the federal health insurance program primarily for people aged 65 and older, consists of Part A (hospital insurance) and Part B (medical insurance). While Medicare provides significant coverage, there are certain out-of-pocket costs, such as deductibles, copayments, and coinsurance, that beneficiaries are responsible for. This is where supplemental insurance plans come into play, as they are designed to fill in these financial gaps and provide you with greater peace of mind.

The Purpose of Supplemental Insurance Plans

Supplemental insurance plans, or Medigap policies, serve as additional coverage to bridge the gaps left by Medicare. Understanding the purpose of these plans is crucial to grasp the full extent of their benefits and how they can provide you with comprehensive coverage. With a Medigap plan, you can rest assured that you won't be burdened with overwhelming out-of-pocket expenses for your healthcare needs.

Exploring Coverage Options

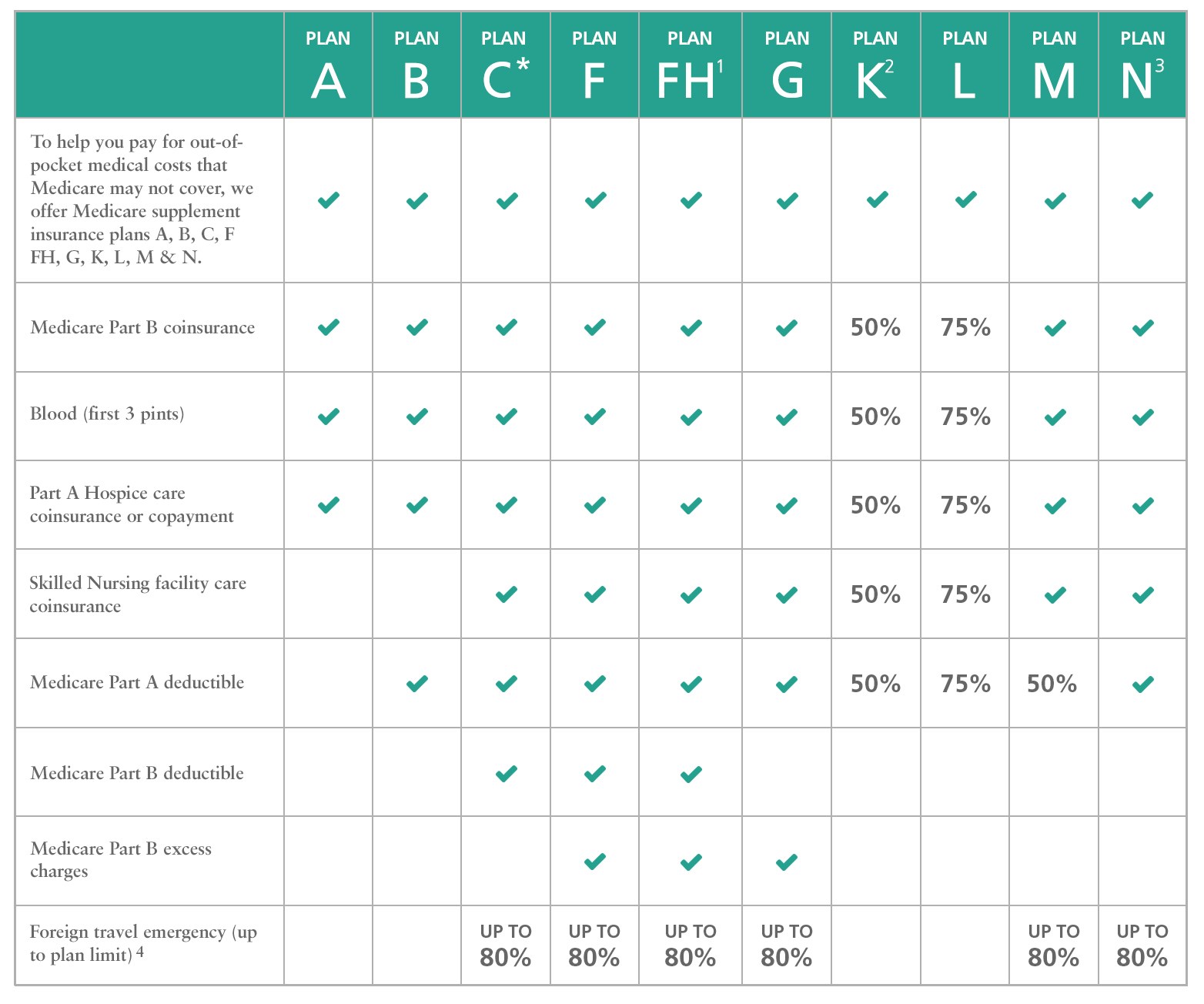

When it comes to supplemental insurance plans, there are several coverage options available. These options are standardized across most states, with each plan identified by a letter (A, B, C, D, F, G, K, L, M, and N). It's important to understand the benefits and coverage provided by each plan to determine which one best suits your needs.

For example, Plan A is the most basic Medigap plan, covering only a few essential benefits. On the other hand, Plan F offers the most comprehensive coverage, including coverage for Medicare Part B excess charges and foreign travel emergencies. By comparing the coverage options and benefits of each plan, you can make an informed decision based on your specific healthcare needs.

Standardized Plans and Benefits

One of the key advantages of Medigap plans is their standardization. This means that the benefits offered by each plan are the same, regardless of the insurance company you choose. For instance, if you opt for Plan G from one insurance company, the coverage and benefits will be identical to Plan G from another insurer.

Standardized plans provide peace of mind and ensure that you receive the same level of coverage, regardless of the provider you select. This makes it easier to compare different insurance companies and their pricing structures, as the benefits remain constant. It's essential to understand the standardized plans and their benefits to make an informed decision that aligns with your needs and budget.

Eligibility and Enrollment

Understanding the eligibility requirements for enrolling in a supplemental insurance plan is essential. While most people become eligible for Medicare at age 65, the eligibility criteria for Medigap plans may differ. Generally, to be eligible for a Medigap policy, you must be enrolled in both Medicare Part A and Part B.

Initial Enrollment Period

The Initial Enrollment Period (IEP) is the first opportunity for you to enroll in a Medigap plan. It begins three months before your 65th birthday and continues for three months after. During this period, you have guaranteed issue rights, meaning that insurance companies cannot deny you coverage or charge higher premiums based on your health condition.

To take advantage of the IEP and secure the Medigap plan that best suits your needs, it's crucial to understand the enrollment process and the timeframes involved. Missing the IEP may result in higher premiums or even a denial of coverage, so it's important to be proactive and enroll in a Medigap plan during this period.

Special Enrollment Periods

In addition to the IEP, certain circumstances may qualify you for a Special Enrollment Period (SEP) to enroll in a Medigap plan. For instance, if you're covered under an employer's health insurance plan when you turn 65, you may be eligible for an SEP once that coverage ends. Understanding the various SEP options and their requirements is essential to ensure you don't miss out on the opportunity to enroll in a Medigap plan.

Coverage Options and Benefits

Medigap plans offer a range of coverage options and benefits to ensure your healthcare needs are adequately met. Understanding these options and benefits is crucial to determine which plan aligns with your specific requirements. Let's explore some of the coverage options and benefits typically offered by Medigap policies.

Coverage for Medicare Part A Coinsurance and Hospital Costs

Medicare Part A covers hospital stays, but it also comes with certain costs. Medigap plans can help cover these costs, including the Part A deductible and coinsurance amounts that you would otherwise be responsible for. This coverage ensures that you won't face significant financial burdens when receiving inpatient hospital care.

Coverage for Medicare Part B Coinsurance and Copayments

Medicare Part B covers medical services such as doctor visits, lab tests, and preventive care. However, it also includes coinsurance and copayments that can add up over time. Medigap plans can help alleviate these costs, ensuring that you have access to necessary medical services without worrying about excessive out-of-pocket expenses.

Coverage for Blood Transfusions

In certain medical situations, you may require blood transfusions. While Medicare covers the first three pints of blood, any additional pints are typically not covered. Medigap plans can help bridge this gap by providing coverage for the additional pints of blood, ensuring you receive the necessary medical care without incurring substantial costs.

Coverage for Skilled Nursing Facility Care

If you need skilled nursing facility (SNF) care after a hospital stay, Medicare provides coverage for the first 20 days. However, after the 20th day, you may be responsible for a daily coinsurance amount. Medigap plans can help cover this coinsurance, ensuring that you receive the necessary SNF care without worrying about the financial implications.

Coverage for Medicare Part A Deductible

Medicare Part A comes with a deductible that you must pay before receiving coverage for hospital stays. Medigap plans can provide coverage for this deductible, ensuring that you have access to hospital care without having to worry about the upfront costs.

Coverage for Medicare Part B Excess Charges

Medicare Part B has a set fee schedule for doctors' services and other medical procedures. However, some doctors may choose to charge more than the Medicare-approved amount, resulting in excess charges. Medigap plans that offer coverage for Part B excess charges ensure that you won't have to pay these additional costs out of pocket.

Coverage for Foreign Travel Emergency

For those who enjoy travel or spend significant time abroad, having coverage for foreign travel emergencies is essential. Medigap plans can provide coverage for emergency medical care outside of the United States, giving you peace of mind and financial protection during your international travels.

Additional Benefits and Options

In addition to the core coverage options mentioned above, some Medigap plans may offer additional benefits and options. These may include coverage for preventive care, at-home recovery services, or even coverage for deductibles related to Medicare Part B. Understanding these additional benefits can help you select a plan that aligns more closely with your specific healthcare needs.

Comparison of Plans

With various Medigap plans available, it's crucial to compare the options to make an informed decision. While the coverage options are standardized, the premiums charged by insurance companies may differ. Let's explore some key factors to consider when comparing Medigap plans.

Understanding Standardized Benefits

As mentioned earlier, the benefits provided by each Medigap plan are standardized. This means that, for example, Plan F from one insurance company offers the same coverage as Plan F from another insurer. Understanding this standardization allows you to compare plans more effectively, focusing on factors such as premiums, reputation, and customer service.

Comparing Premiums

Premiums for Medigap plans can vary significantly between insurance companies. When comparing plans, it's important to consider the monthly premiums and how they fit into your budget. Keep in mind that while higher-premium plans may offer more comprehensive coverage, they may not always be the most cost-effective option for your specific needs.

Evaluating Insurance Companies

The reputation and financial stability of the insurance company offering the Medigap plan are important factors to consider. You want to ensure that the company has a strong track record of providing reliable coverage and excellent customer service. Researching and comparing different insurance companies' reputations and customer reviews can help you make an informed decision.

Considering Coverage Requirements

When comparing Medigap plans, consider your specific healthcare needs and any anticipated medical expenses. Some plans may provide coverage for benefits that you don'tcurrently require, while others may offer more suitable coverage options. By evaluating your coverage requirements, you can choose a Medigap plan that aligns with your healthcare needs and provides the most value for your money.

Assessing Cost-Sharing Requirements

In addition to premiums, it's important to evaluate the cost-sharing requirements of Medigap plans. This includes factors such as deductibles, copayments, and coinsurance. Understanding these cost-sharing aspects will help you determine the overall financial impact of each plan and choose the one that offers the most favorable cost-sharing structure for your needs.

Considering Future Healthcare Needs

While it's essential to assess your current healthcare needs, it's equally important to consider your future needs. As you age, your healthcare requirements may change, and having a Medigap plan that accommodates potential future needs can provide valuable peace of mind. Consider factors such as potential surgeries, ongoing medical conditions, and the likelihood of needing long-term care when evaluating different Medigap plans.

Seeking Expert Advice

Choosing the right Medigap plan can be a complex and overwhelming process. If you find yourself struggling to navigate through the options or understand the nuances of each plan, don't hesitate to seek expert advice. Insurance brokers or Medicare counselors can provide valuable guidance and help you make an informed decision based on your unique circumstances.

Choosing the Right Plan for Your Needs

With various options available, selecting the right supplemental insurance plan can be overwhelming. However, by following some key considerations, you can make an informed decision that aligns with your specific healthcare needs and financial situation.

Evaluate Your Healthcare Needs

The first step in choosing the right Medigap plan is to evaluate your current and anticipated healthcare needs. Consider factors such as your overall health, any chronic conditions you may have, and the frequency of doctor visits or medical procedures. By understanding your healthcare needs, you can focus on finding a plan that provides comprehensive coverage for the services you require.

Consider Your Budget

While having comprehensive coverage is important, it's equally crucial to choose a plan that fits within your budget. Evaluate your financial situation and determine how much you can comfortably afford in terms of monthly premiums and cost-sharing requirements. Balancing your healthcare needs with your budget will help you find a plan that provides adequate coverage without straining your finances.

Compare Plan Options

Take the time to compare the different Medigap plans available, considering factors such as coverage options, benefits, premiums, and reputation of insurance companies. Use the information provided by insurance providers, online resources, and expert advice to make an informed comparison. By weighing the pros and cons of each plan, you can narrow down your options to those that best align with your needs.

Consider Future Needs

While evaluating your current healthcare needs is crucial, it's also important to consider your future needs. As you age, your healthcare requirements may change, and having a Medigap plan that can adapt to those changing needs is advantageous. Consider factors such as potential surgeries, ongoing medical conditions, and the likelihood of needing long-term care when assessing different Medigap plans.

Read and Understand the Fine Print

Before committing to a Medigap plan, read and understand the fine print. Pay close attention to any limitations, restrictions, or exclusions that may apply to the coverage. It's important to have a clear understanding of what is covered and what is not to avoid any surprises or misunderstandings down the line.

Seek Expert Advice

If you're feeling overwhelmed or unsure about choosing the right Medigap plan, don't hesitate to seek expert advice. Insurance brokers, Medicare counselors, or even trusted healthcare professionals can provide valuable insights and guidance. They can help you navigate through the complexities of Medigap plans and ensure you make a decision that best suits your specific needs.

Understanding Premiums and Costs

When it comes to supplemental insurance plans, understanding the premiums and costs associated with Medigap policies is essential. By having a clear understanding of how premiums are calculated and what factors can influence costs, you can make informed decisions and potentially save money in the long run.

How Premiums are Calculated

The premiums for Medigap plans are determined by insurance companies based on various factors. These factors may include your age, location, gender, and even the specific plan you choose. Understanding how premiums are calculated will give you insight into why certain plans may be priced differently and help you evaluate whether the premiums align with your budget.

Factors Influencing Costs

In addition to the factors considered in premium calculations, there are other elements that can influence the overall costs of Medigap plans. For instance, some plans may require higher cost-sharing through deductibles or coinsurance, leading to higher out-of-pocket expenses. Evaluating these factors and their potential impact on your overall costs is crucial when comparing different Medigap plans.

Potential Cost-Saving Strategies

While Medigap plans have associated costs, there are strategies you can employ to potentially save money. For example, some insurance companies offer household discounts if both you and your spouse enroll in the same plan. Additionally, reviewing your plan annually and comparing options can help you identify any cost-saving opportunities or potentially switch to a more affordable plan that still meets your needs.

Considering Long-Term Costs

When evaluating the premiums and costs of Medigap plans, it's important to consider the long-term perspective. While a plan with lower premiums may seem attractive initially, it may have higher cost-sharing requirements that could result in higher overall costs in the long run. Considering your anticipated healthcare needs and potential expenses over time will help you choose a plan that provides the most value for your money.

Medigap Open Enrollment Period

The Medigap Open Enrollment Period (OEP) is a critical period for purchasing a supplemental insurance plan. It's important to understand the significance of this enrollment period, its duration, and the advantages it offers, including guaranteed issue rights.

Duration of the Medigap Open Enrollment Period

The Medigap Open Enrollment Period begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. It lasts for six months, providing you with ample time to explore and select a Medigap plan that suits your needs.

Guaranteed Issue Rights

During the Medigap Open Enrollment Period, you have guaranteed issue rights. This means that insurance companies cannot deny you coverage or charge you higher premiums based on your health condition or pre-existing medical conditions. This is a significant advantage, as it ensures that you can secure a Medigap plan without worrying about potential coverage denials or increased costs due to your health status.

Importance of Enrolling During the OEP

Enrolling in a Medigap plan during the Open Enrollment Period is crucial for several reasons. Firstly, it provides you with guaranteed issue rights, as mentioned earlier. Secondly, enrolling during this period ensures that you have comprehensive coverage in place as soon as you become eligible for Medicare. Delaying enrollment may result in gaps in coverage and potential out-of-pocket expenses.

Enrollment Options Outside the OEP

While the Open Enrollment Period provides the most advantageous opportunity to enroll in a Medigap plan, it's important to note that you can still enroll outside of this period. However, outside the OEP, insurance companies may consider your health condition and medical history when determining your eligibility and setting premiums. This could result in higher costs or even denial of coverage based on pre-existing conditions.

Medigap versus Medicare Advantage

When exploring supplemental insurance options for Medicare, you may come across Medicare Advantage plans as an alternative to Medigap. Understanding the differences between Medigap and Medicare Advantage can help you make an informed decision about which option is best suited to your needs.

Medigap: Supplementing Original Medicare

Medigap plans, as discussed earlier, are designed to supplement Original Medicare (Part A and Part B). They help cover the out-of-pocket costs and gaps left by Medicare by offering additional coverage options. Medigap plans work in conjunction with Original Medicare, allowing you to see any doctor or specialist who accepts Medicare.

Medicare Advantage: An Alternative to Original Medicare

Medicare Advantage plans, on the other hand, provide an alternative to Original Medicare. These plans are offered by private insurance companies approved by Medicare and combine the coverage of Part A and Part B into a single plan. Medicare Advantage plans often include additional benefits, such as prescription drug coverage and dental or vision services.

Choosing Between Medigap and Medicare Advantage

When deciding between Medigap and Medicare Advantage, there are several factors to consider. If you prefer the flexibility of seeing any doctor who accepts Medicare and want comprehensive coverage for out-of-pocket costs, Medigap may be the better option. On the other hand, if you prefer the convenience of having all your healthcare needs bundled under one plan and are comfortable with network restrictions, a Medicare Advantage plan may be more suitable.

Understanding Network Restrictions

It's important to note that Medicare Advantage plansoften have network restrictions, meaning you may need to use healthcare providers within a specific network to receive full coverage. If you have established relationships with certain doctors or specialists, it's important to check if they are included in the network of the Medicare Advantage plan you're considering. This will ensure that you can continue receiving care from your preferred healthcare providers without incurring additional out-of-pocket costs.

Considering Prescription Drug Coverage

One significant difference between Medigap and Medicare Advantage plans is the inclusion of prescription drug coverage. While Medigap plans do not cover prescription drugs, Medicare Advantage plans often include this coverage. If you require ongoing prescription medications, it's essential to consider whether a Medicare Advantage plan's prescription drug coverage aligns with your needs and if there are any restrictions or limitations on the medications covered.

Evaluating Cost Structures

When comparing Medigap and Medicare Advantage plans, it's important to evaluate the cost structures of each option. Medigap plans typically have higher monthly premiums but lower out-of-pocket costs when you receive healthcare services. Medicare Advantage plans, on the other hand, often have lower premiums but may have higher copayments, deductibles, or other cost-sharing requirements. Consider your healthcare needs, budget, and preferences to determine which cost structure is more favorable for you.

Considering Long-Term Flexibility

Another factor to consider is long-term flexibility. Medigap plans provide consistent coverage and allow you to switch between plans at any time, subject to underwriting requirements. Medicare Advantage plans, however, have annual enrollment periods and may have restrictions on switching plans outside of those periods. If you anticipate potential changes in your healthcare needs or preferences in the future, having the flexibility to switch Medigap plans may be advantageous.

Frequently Asked Questions

When it comes to supplemental insurance plans for Medicare, there are often common questions and concerns. Addressing these questions can help provide clarity and ensure that individuals have a thorough understanding of the topic. Here are answers to some frequently asked questions about Medigap plans:

1. What is the difference between Original Medicare and Medigap?

Original Medicare (Part A and Part B) is the federal health insurance program for people aged 65 and older. Medigap plans, on the other hand, are supplemental insurance plans offered by private insurance companies to fill in the gaps of Original Medicare coverage.

2. Can I have both a Medigap plan and a Medicare Advantage plan?

No, you cannot have both a Medigap plan and a Medicare Advantage plan simultaneously. Medigap plans only work with Original Medicare, while Medicare Advantage plans are an alternative to Original Medicare.

3. Can I switch Medigap plans?

Yes, you can switch Medigap plans at any time. However, switching plans may be subject to underwriting requirements, and it's important to consider any potential waiting periods or pre-existing condition limitations.

4. Can I purchase a Medigap plan if I have a pre-existing condition?

During the Medigap Open Enrollment Period, insurance companies cannot deny you coverage or charge you higher premiums based on pre-existing conditions. However, outside of this period, insurance companies may consider your health condition when determining eligibility and setting premiums.

5. Will my Medigap plan cover prescription drugs?

No, Medigap plans do not cover prescription drugs. If you require prescription drug coverage, you may need to enroll in a separate Medicare Part D prescription drug plan.

6. Are Medigap plans available to individuals under 65 with disabilities?

In most states, Medigap plans are only available to individuals aged 65 and older. However, some states may offer Medigap plans to individuals under 65 with certain disabilities or medical conditions.

7. Can I use my Medigap plan for healthcare services outside of the United States?

Most Medigap plans do not provide coverage for healthcare services outside of the United States. However, some plans may offer limited coverage for emergency medical care during foreign travel.

8. How do I find a reputable insurance company offering Medigap plans?

To find a reputable insurance company offering Medigap plans, you can start by researching insurance providers in your area. Look for companies with a strong reputation, positive customer reviews, and a track record of reliable coverage and customer service. Additionally, seeking advice from insurance brokers or Medicare counselors can help you find reputable options.

Best Practices for Managing Supplemental Insurance Plans

Once you have selected and enrolled in a Medigap plan, effectively managing your supplemental insurance is crucial to ensure you maximize its benefits. Here are some best practices to help you navigate and make the most of your Medigap plan:

Review Your Plan Annually

It's important to review your Medigap plan annually to ensure it continues to meet your healthcare needs. Changes in your health, anticipated medical expenses, or changes in plan offerings may warrant a reassessment of your coverage. Reviewing your plan annually allows you to make any necessary adjustments or switch to a different plan that better suits your needs.

Understand Any Changes to Your Plan

Insurance companies may make changes to their Medigap plans from time to time. It's crucial to stay informed about any changes to your plan, such as modifications to coverage or premiums. Review communications from your insurance company and reach out to them directly if you have any questions or concerns about the changes.

Utilize Preventive Care Services

Medigap plans often provide coverage for preventive care services, such as screenings and vaccinations. Take advantage of these benefits to maintain your overall health and prevent potential health issues. Regular preventive care can help identify and address health concerns early on, potentially saving you from more serious health complications down the line.

Keep Track of Medical Expenses

Keeping track of your medical expenses is essential for understanding your healthcare costs and identifying any potential discrepancies or errors. Maintain records of bills, explanations of benefits, and any other relevant documentation. This will help you monitor your expenses, ensure accurate billing, and identify any potential issues that need to be addressed with your insurance company.

Stay Informed About Medicare Changes

Being aware of any changes to the Medicare program is crucial for managing your Medigap plan effectively. Stay informed about updates to Medicare policies, coverage options, and any legislative or regulatory changes that may impact your supplemental insurance. This will allow you to adapt to any modifications and make informed decisions regarding your healthcare coverage.

Seek Assistance When Needed

If you encounter challenges or have questions about your Medigap plan, don't hesitate to seek assistance. Reach out to your insurance company's customer service department for guidance or clarification. Additionally, insurance brokers or Medicare counselors can provide expert advice and support to help you navigate any issues or concerns that arise.

In conclusion, understanding supplemental insurance plans for Medicare is vital for ensuring comprehensive coverage and financial peace of mind. By exploring the purpose, coverage options, eligibility, costs, and other crucial aspects of Medigap plans, you can make informed decisions that align with your unique healthcare needs and financial situation. Remember to evaluate your healthcare needs, compare plan options, and seek expert advice when necessary. With careful consideration and proactive management, you can maximize the benefits of your supplemental insurance plan and enjoy a more secure future.

Posting Komentar untuk "Understanding Supplemental Insurance Plans for Medicare: A Comprehensive Guide"