Exploring the Pros and Cons of Whole Life Insurance: A Comprehensive Guide

Are you considering whole life insurance but unsure of its benefits and drawbacks? Look no further! In this comprehensive guide, we will delve into the world of whole life insurance, exploring its advantages and disadvantages, helping you make an informed decision. Whether you are a first-time buyer or seeking to understand the nuances of this type of insurance, this article aims to provide you with all the information you need.

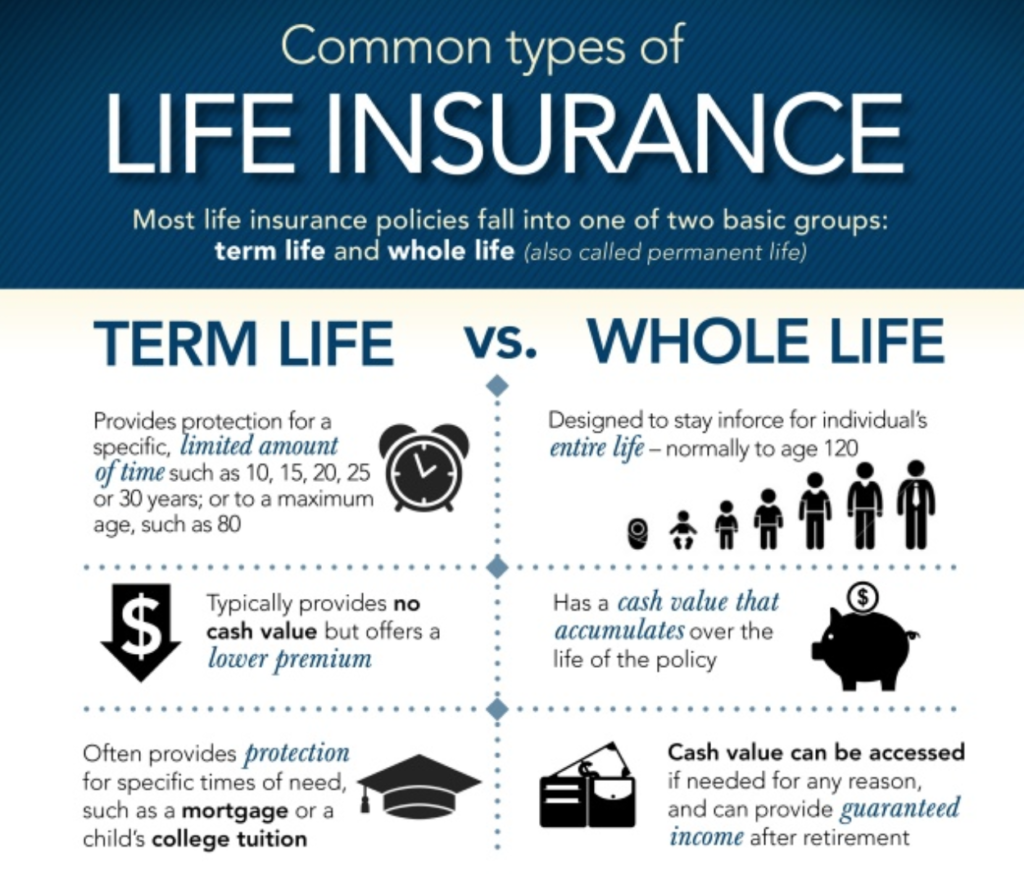

Before we dive into the details, let's first understand what whole life insurance entails. Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime. Unlike term life insurance, which covers you for a specific period, whole life insurance offers lifelong protection, as long as you continue to pay the premiums. It not only provides a death benefit but also accumulates cash value over time, making it a potential investment vehicle.

What is Whole Life Insurance?

Whole life insurance is a multifaceted financial product that combines death benefit protection with a savings component. It guarantees that your beneficiaries will receive a payout upon your death, regardless of when it occurs, as long as the policy remains in force. Additionally, whole life insurance policies come with a cash value component that accumulates over time.

Features of Whole Life Insurance

Whole life insurance comes with several key features that set it apart from other types of life insurance. Firstly, it offers lifetime coverage, meaning you are insured until the day you pass away, as long as you continue to pay the premiums. Secondly, whole life insurance policies have a fixed premium that remains the same throughout the life of the policy. This can be advantageous as it allows for predictable budgeting and eliminates the risk of premium increases.

Furthermore, whole life insurance policies have a cash value component that grows over time. A portion of each premium payment goes towards this cash value, which can be accessed during your lifetime. This cash value can be utilized for various purposes, such as supplementing retirement income, funding education expenses, or even as collateral for a loan.

Types of Whole Life Insurance

There are different types of whole life insurance policies available to suit your unique needs and financial goals. The most common types include traditional whole life insurance, universal life insurance, and variable life insurance.

Traditional whole life insurance is the most straightforward and conservative option. It offers a guaranteed death benefit, fixed premiums, and a conservative cash value growth rate. This type of policy is suitable for individuals who value stability and predictability.

Universal life insurance, on the other hand, provides more flexibility in terms of premium payments and death benefit amounts. It allows policyholders to adjust their premiums and death benefits within certain limits. Universal life insurance policies also offer the potential for higher cash value growth rates, depending on the performance of the underlying investments.

Variable life insurance combines a death benefit with investment options. Policyholders have the opportunity to allocate their premiums into various investment accounts, such as stocks, bonds, or mutual funds. The cash value of the policy fluctuates based on the performance of these investments. Variable life insurance is suitable for individuals who are comfortable with market fluctuations and want the potential for higher returns.

Benefits of Whole Life Insurance

Whole life insurance offers several benefits that make it an attractive option for many individuals. By understanding these advantages, you can determine if whole life insurance aligns with your financial goals and provides the protection you need.

Lifelong Coverage

One of the primary advantages of whole life insurance is that it provides coverage for your entire lifetime. As long as you continue to pay the premiums, your policy remains in force, ensuring that your loved ones receive a death benefit when you pass away, regardless of your age at the time of death. This lifelong coverage can provide peace of mind, knowing that your family will be financially protected no matter when the unfortunate event occurs.

Cash Value Accumulation

Unlike term life insurance, which does not accumulate any cash value, whole life insurance policies have a cash value component that grows over time. A portion of each premium payment goes towards this cash value, which accumulates on a tax-deferred basis. This means that the growth of the cash value is not subject to immediate taxation, allowing it to compound and potentially provide significant returns over the long term.

The cash value can be accessed in several ways. Policyholders can take out loans against the cash value, withdraw a portion of it, or use it to pay premiums. These options provide flexibility and can be particularly useful during times of financial need or when additional funds are required for various purposes, such as education expenses or unexpected medical bills.

Potential Tax Advantages

Whole life insurance policies offer potential tax advantages that can be advantageous for individuals in certain financial situations. The death benefit paid to your beneficiaries is generally income tax-free. This means that the funds received by your loved ones upon your death are not subject to federal income taxes, providing them with a significant financial benefit during a challenging time.

In addition to the tax-free death benefit, the cash value growth within the policy is also tax-deferred. This means that you do not have to pay taxes on the growth of the cash value until you withdraw or surrender the policy. This tax deferral allows the cash value to grow at a faster rate compared to taxable investments, potentially providing you with a higher return on your investment.

Estate Planning Tool

Whole life insurance can serve as a valuable tool for estate planning purposes. If you have substantial assets that you wish to pass on to your heirs, whole life insurance can help facilitate the transfer of wealth in a tax-efficient manner. The death benefit paid out by the policy can provide the necessary liquidity to cover estate taxes, ensuring that your beneficiaries receive the intended inheritance without the burden of significant tax liabilities.

In addition to estate tax planning, whole life insurance can also be used for other estate planning goals, such as equalizing inheritances among multiple heirs or funding a trust to provide for the financial well-being of loved ones. The flexibility and potential tax advantages make whole life insurance an attractive option for individuals looking to incorporate insurance into their overall estate planning strategy.

Drawbacks of Whole Life Insurance

While whole life insurance offers several advantages, it also comes with certain drawbacks that you should consider before making a decision. By understanding these potential disadvantages, you can make an informed choice and determine if whole life insurance aligns with your financial needs and goals.

Higher Premiums

One of the primary drawbacks of whole life insurance is the higher premiums compared to term life insurance. The lifelong coverage and cash value component of whole life insurance result in higher premium payments. These premiums can be a financial burden for some individuals, especially if they are on a tight budget or have other pressing financial obligations.

It is important to carefully evaluate your financial situation and determine if you can comfortably afford the premiums throughout the life of the policy. Failing to pay the premiums can result in the policy lapsing and losing the benefits associated with whole life insurance. Assessing your financial capability and ensuring that the premiums fit within your budget is crucial when considering whole life insurance.

Limited Flexibility

Whole life insurance policies have limited flexibility compared to other types of life insurance, such as term life insurance. Once you commit to a whole life insurance policy, you are locked into the premiums, death benefit, and cash value growth rate for the duration of the policy. Changes to these elements may require additional underwriting or result in the loss of certain benefits.

This limited flexibility can be a disadvantage if your financial circumstances change over time. For example, if you experience a significant increase in income and want to increase your coverage, you may need to purchase an additional policy rather than modifying your existing whole life insurance policy. This lack of flexibility can be inconvenient and potentially more costly in the long run.

Risks Associated with Cash Value

While the cash value component of whole life insurance can be an attractive feature, it also comes with certain risks. The growth of the cash value is dependent on various factors, such as the performance of the underlying investments and the expenses charged by the insurance company. If the investments do not perform well or the expenses are high, the cash value growth may be lower than anticipated.

Furthermore, policy loans taken against the cash value can have implications on the long-term performance of the policy. If the loans are not repaid or the interest accrues, it can deplete the cash value and potentially result in the policy lapsing. It is crucial to carefully consider the implications of borrowing against the cash value and ensure that you have a plan in place to repay any loans taken.

Complexity and Understanding

Whole life insurance is a complex financial product that may require a deeper understanding compared to simpler insurance options. The interplay between the death benefit, cash value, premiums, and potential riders can be confusing for individuals who are not familiar with the intricacies of life insurance.

It is essential to thoroughly review the policy documents, ask questions, and seek professional advice when considering whole life insurance. This will ensure that you have a clear understanding of how the policy works, its potential benefits, and any limitations or risks associated with it. Taking the time to educate yourself about whole life insurance can help you make an informed decision and avoid any surprises in the future.

Whole Life Insurance vs. Term Life Insurance

Whole Life Insurance vs. Term Life Insurance

Choosing between whole life insurance and term life insurance can be a significant decision. Each type of insurance offers unique features and benefits, and understanding the differences between the two can help you determine which option best suits your needs.

Differences in Coverage Length

The most fundamental difference between whole life insurance and term life insurance is the coverage length. Whole life insurance provides coverage for your entire lifetime, while term life insurance covers you for a specific period, typically ranging from 10 to 30 years. The coverage duration of term life insurance is predetermined at the time of purchase, and if the policyholder passes away during the term, a death benefit is paid out to the beneficiaries.

On the other hand, whole life insurance offers lifelong coverage, meaning that the policy remains in force until the policyholder's death, as long as the premiums are paid. The death benefit is guaranteed, regardless of when the policyholder passes away, providing peace of mind and long-term financial protection for loved ones.

Premiums and Affordability

Term life insurance generally has lower premiums compared to whole life insurance. Since term life insurance covers a specific period and does not accumulate cash value, the premiums are typically more affordable. This makes term life insurance an attractive option for individuals who require temporary coverage or have limited budgets.

In contrast, whole life insurance premiums are higher due to the lifelong coverage and cash value component. The premiums are designed to cover the insurance costs, provide for the death benefit, and contribute to the cash value growth. While the higher premiums may be a deterrent for some individuals, they provide lifelong protection and potential financial benefits that term life insurance does not offer.

Cash Value Accumulation

One of the key distinctions between whole life insurance and term life insurance is the cash value component. Whole life insurance policies accumulate cash value over time, which grows on a tax-deferred basis. A portion of each premium payment is allocated towards the cash value, allowing it to grow over the years.

Term life insurance, on the other hand, does not have a cash value component. Since term life insurance is focused solely on providing death benefit protection, there is no accumulation of cash value. This means that the premiums paid for term life insurance are solely for the coverage during the specified term.

Flexibility and Customization

Term life insurance offers more flexibility and customization options compared to whole life insurance. With term life insurance, you can choose the coverage duration that best aligns with your needs, such as 10, 20, or 30 years. This flexibility allows you to match the coverage period with specific financial obligations, such as a mortgage or your children's education expenses.

Whole life insurance, on the other hand, has limited flexibility and customization options. Once the policy is in force, the premiums, death benefit, and cash value growth rate are fixed. Any modifications to these elements may require additional underwriting or result in the loss of certain benefits. This lack of flexibility can be a disadvantage if your financial circumstances change over time.

Considerations in Choosing Between Whole Life Insurance and Term Life Insurance

When deciding between whole life insurance and term life insurance, it is essential to consider your specific financial goals, budget, and coverage needs.

If you are looking for temporary coverage to protect your loved ones during a specific period, such as while paying off a mortgage or until your children are financially independent, term life insurance may be the more suitable option. It offers affordable premiums and flexibility to align the coverage duration with your specific needs.

On the other hand, if you require lifelong coverage, potential financial benefits, and the peace of mind that comes with knowing your loved ones will be financially protected regardless of when you pass away, whole life insurance may be the better choice. While the premiums are higher, the lifelong coverage and cash value accumulation can provide long-term financial security and potential tax advantages.

Factors to Consider Before Buying Whole Life Insurance

Before purchasing whole life insurance, it is crucial to consider various factors and evaluate your financial situation. By doing so, you can ensure that whole life insurance aligns with your financial goals and provides the protection you need.

Evaluate Your Financial Goals

One of the first considerations is to evaluate your financial goals and determine how whole life insurance fits into your overall financial plan. Consider what you want to achieve in the long term, such as providing for your family's financial security, funding education expenses, or leaving a legacy for future generations.

Whole life insurance can be a valuable tool for achieving these goals, but it is essential to ensure that the premiums and potential cash value growth align with your objectives. Assessing your financial goals will help you determine the appropriate coverage amount, premium affordability, and potential benefits associated with whole life insurance.

Assess Your Budget

Whole life insurance premiums are typically higher compared to term life insurance. Therefore, it is crucial to assess your budget and determine if you can comfortably afford the premiums throughout the life of the policy. Failing to pay the premiums can result in the policy lapsing and losing the benefits associated with whole life insurance.

Consider your income, expenses, and any other financial obligations you have. Evaluate how the premiums fit within your budget and whether you can sustain the payments over the long term. It may be helpful to speak with a financial advisor to ensure that the premiums are manageable and do not put excessive strain on your financial situation.

Evaluate Your Coverage Needs

Another important factor to consider is your coverage needs. Assess the financial obligations you want to protect your loved ones from in the event of your death. Consider factors such as outstanding mortgages, outstanding debts, education expenses, and the financial well-being of your dependents.

Whole life insurance provides lifelong coverage, ensuring that your beneficiaries receive a death benefit whenever you pass away. This can be beneficial if you have ongoing financial obligations or want to leave an inheritance for your loved ones. However, it is crucial to evaluate if the coverage amount aligns with your needs and if the potential benefits outweigh the higher premiums.

Review the Policy Terms and Riders

Before purchasing whole life insurance, thoroughly review the policy terms and conditions. Understand the specifics of the policy, including the death benefit, cash value growth rate, premium payment schedule, and any potential riders or additional benefits included.

Policy riders can enhance the coverage and provide additional benefits, such as accelerated death benefit riders, which allow you to receive a portion of the death benefit if you are diagnosed with a terminal illness. However, it is important to consider the cost of these riders and determine if they align with your specific needs and financial goals.

Educate Yourself and Seek Professional Advice

Whole life insurance is a complex financial product, and it is essential to educate yourself and seek professional advice before making a decision. Take the time to understand how whole life insurance works, the potential benefits and drawbacks, and how it fits into your overall financial plan.

Consulting with a licensed insurance agent or financial advisor can provide valuable insights and guidance. They can help you assess your needs, evaluate different policy options, and ensure that you make an informed decision that aligns with your financial goals.

Understanding the Cash Value Component

The cash value component is a unique feature of whole life insurance that sets it apart from other types of life insurance. Understanding how the cash value works, its growth potential, and the various options for utilizing it can help you make the most of your whole life insurance policy.

How Does Cash Value Accumulate?

The cash value component of whole life insurance grows over time through a combination of premium payments and the accumulation of interest or dividends. A portion of each premium payment is allocated towards the cash value, which accumulates on a tax-deferred basis.

The cash value growth rate is determined by various factors, such as the policy's guarantees, the performance of the insurance company's investments, and the expenses associated with administering the policy. The cash value growth rate is typically conservative but provides steady growth over the long term.

Accessing the Cash Value

One of the significant advantages of whole life insurance is the ability to access the accumulated cash value during your lifetime. There are several options for utilizing the cash value:

Policy Loans:

You can borrow against the cash value by taking out a policy loan. The loan amount is typically limited to a percentage of the cash value, and interest is charged on the borrowed amount. Policy loans provide flexibility and can be used for various purposes, such as covering unexpected expenses or supplementing retirement income. It is important to note that policy loans are not required to be repaid, but any outstanding loans at the time of death will be deducted from the death benefit.

Withdrawals:

You can make partial withdrawals from the cash value, effectively reducing the death benefit. Withdrawals are tax-free up to the amount you have paid in premiums. However, any withdrawals above the amount of premiums paid may be subject to income tax. It is important to carefully consider the tax implications and potential reduction in the death benefit before making withdrawals.

Premium Payments:

Another option is to use the cash value to pay premiums. If you have accumulated sufficient cash value, you can use it to cover yourpremium payments instead of paying out of pocket. This can be particularly useful during times of financial strain or when you want to redirect funds towards other financial priorities.

Surrendering the Policy:

If you no longer need the coverage or wish to terminate the policy, you can surrender it and receive the cash value. Surrendering the policy means forfeiting the death benefit, but you will receive the accumulated cash value, minus any applicable surrender charges or fees. It is important to carefully consider the implications of surrendering the policy, as it may result in a loss of coverage and potential tax consequences.

Implications of Policy Loans and Withdrawals

While accessing the cash value through policy loans or withdrawals can provide financial flexibility, it is essential to consider the implications of these actions.

Policy loans accrue interest, which is charged on the borrowed amount. If the loan is not repaid or the interest accrues, it can deplete the cash value and potentially result in the policy lapsing. It is crucial to have a plan in place to repay any loans taken against the cash value to ensure the long-term viability of the policy.

Withdrawals from the cash value may have tax implications. Any withdrawals above the amount of premiums paid may be subject to income tax. Additionally, making significant withdrawals can reduce the death benefit, potentially leaving your beneficiaries with a smaller payout. It is important to carefully consider the tax implications and potential reduction in coverage before making withdrawals.

Understanding Dividends

Some whole life insurance policies may pay dividends, which are a share of the insurance company's profits. Dividends are not guaranteed and are dependent on the financial performance of the insurance company. If a policy pays dividends, you have several options for utilizing them:

Cash:

You can receive the dividends in cash, which can provide additional income or be used for other financial purposes. However, it is important to note that cash dividends may be subject to income tax.

Premium Reduction:

Dividends can be used to reduce future premium payments. By applying the dividends towards your premiums, you can effectively lower your out-of-pocket expenses while maintaining the same level of coverage.

Accumulation:

Another option is to allow the dividends to accumulate within the policy. Accumulated dividends can increase the cash value and potentially provide higher returns over time. It is important to review the policy terms and conditions to understand how dividends are credited and the potential impact on the cash value growth.

Tax Implications of the Cash Value

While the growth of the cash value within a whole life insurance policy is tax-deferred, it is important to understand the potential tax implications when accessing the cash value or surrendering the policy.

Withdrawals and policy loans are generally tax-free up to the amount of premiums paid. However, any withdrawals or loans above the premiums paid may be subject to income tax. It is important to consult with a tax advisor or financial professional to understand the specific tax rules and implications based on your individual circumstances.

Surrendering the policy may also have tax consequences. Any cash value received upon surrender may be subject to income tax, especially if the surrender amount exceeds the amount of premiums paid. Additionally, surrendering the policy may result in the recognition of previously deferred income, known as gain on surrender. It is crucial to consider the potential tax implications and consult with a tax advisor before surrendering a whole life insurance policy.

Whole Life Insurance as an Investment

One of the unique features of whole life insurance is its potential as an investment vehicle. While the primary purpose of whole life insurance is to provide death benefit protection, it can also serve as a long-term investment strategy.

Cash Value Growth Potential

The cash value component of whole life insurance has the potential to accumulate over time and provide a source of long-term savings. As you make premium payments, a portion is allocated towards the cash value, which grows on a tax-deferred basis. The cash value growth is determined by various factors, such as the performance of the underlying investments and the expenses charged by the insurance company.

The cash value growth rate in whole life insurance policies is typically conservative but provides steady growth over the long term. While the growth may not match that of more aggressive investment options, it offers stability and a guaranteed return. Additionally, the tax-deferred growth allows the cash value to compound over time, potentially providing significant returns.

Asset Allocation and Investment Options

Some whole life insurance policies offer the opportunity to allocate the cash value into different investment options. These options may include bonds, stocks, or mutual funds. This allows policyholders to participate in the potential growth of these investments and potentially achieve higher returns compared to the guaranteed cash value growth rate.

However, it is important to note that the investment options within whole life insurance policies are typically conservative and may have limitations compared to standalone investment vehicles. The primary purpose of whole life insurance is to provide death benefit protection, and the investment component is secondary. Policyholders should carefully review and understand the investment options available within their policy before making any investment decisions.

Considerations for Using Whole Life Insurance as an Investment

When considering using whole life insurance as an investment strategy, there are several factors to take into account:

Long-Term Horizon:

Whole life insurance is a long-term commitment, and the cash value component is designed to provide returns over an extended period. It is important to have a long-term investment horizon and be willing to commit to the policy for the duration necessary to maximize the potential benefits.

Risk Tolerance:

The investment component of whole life insurance is typically conservative and designed to provide stability and guaranteed returns. If you have a higher risk tolerance and are seeking more aggressive investment options, standalone investment vehicles may be more suitable.

Cost-Benefit Analysis:

Consider the costs associated with whole life insurance and compare them to other investment options. Whole life insurance premiums are typically higher compared to term life insurance, and a portion of the premium goes towards the insurance costs. Evaluate whether the potential returns and tax advantages of whole life insurance justify the higher premiums compared to standalone investment options.

Diversification:

It is important to consider diversification when using whole life insurance as an investment strategy. Whole life insurance alone may not provide sufficient diversification to mitigate risk. It is advisable to have a well-rounded investment portfolio that includes a mix of asset classes and investment vehicles to spread risk and maximize potential returns.

Whole Life Insurance for Estate Planning

Whole life insurance can play a crucial role in estate planning, providing financial security and facilitating the transfer of wealth to your beneficiaries. By incorporating whole life insurance into your estate plan, you can ensure that your loved ones are taken care of and potentially mitigate estate taxes.

Preserving Wealth and Providing Liquidity

One of the primary benefits of whole life insurance in estate planning is its ability to preserve wealth and provide liquidity. If you have significant assets that you want to pass on to your beneficiaries, such as property, business interests, or investments, these assets may be subject to estate taxes.

Whole life insurance can provide the necessary liquidity to cover estate taxes, ensuring that your beneficiaries receive the intended inheritance without the burden of significant tax liabilities. The death benefit paid out by the policy can be used to pay estate taxes, allowing your heirs to retain the other assets in the estate.

Equalizing Inheritances

Whole life insurance can also be used to equalize inheritances among multiple beneficiaries. If you have children or other loved ones who may have different financial needs or circumstances, whole life insurance can help ensure that each beneficiary receives an equal share of your estate.

By naming beneficiaries and assigning specific death benefit amounts, you can provide financial support to beneficiaries who may require additional assistance or have fewer assets compared to others. Whole life insurance can help level the playing field and ensure that each beneficiary receives a fair and equitable inheritance.

Trust Funding

Whole life insurance can also be used to fund a trust, providing ongoing financial support for your loved ones. By naming a trust as the beneficiary of the policy, you can specify the terms under which the trust funds will be distributed to your beneficiaries.

This can be particularly beneficial if you have minor children or individuals who may not be financially responsible. The trust can ensure that the proceeds from the whole life insurance policy are distributed in a controlled manner, protecting the financial well-being of your beneficiaries and potentially shielding the funds from creditors or other potential risks.

Common Myths and Misconceptions about Whole Life Insurance

Whole life insurance often faces misconceptions and myths that can cloud the decision-making process. By debunking these myths, you can gain a clearer understanding of this insurance option and make an informed decision based on facts.

Myth: Whole Life Insurance is Too Expensive

One common misconception is that whole life insurance is prohibitively expensive. While it is true that whole life insurance generally has higher premiums compared to term life insurance, the higher premiums provide lifelong coverage and potential financial benefits.

It is essential to consider the long-term financial benefits and potential returns of whole life insurance. The cash value accumulation, tax advantages, and potential for estate planning can outweigh the higher premiums for individuals with specific financial goals and needs.

Myth: Term Life Insurance is Always theBetter Option

Another myth surrounding whole life insurance is that term life insurance is always the better option. While term life insurance may be suitable for individuals who require temporary coverage or have limited budgets, whole life insurance offers lifelong protection and potential financial benefits.

Whole life insurance provides a guaranteed death benefit and the opportunity for cash value accumulation, which term life insurance does not offer. Additionally, whole life insurance can serve as a valuable tool for estate planning and provide tax advantages that term life insurance lacks.

Myth: Cash Value is Not Worthwhile

Some individuals believe that the cash value component of whole life insurance is not worthwhile and that it would be more beneficial to invest in standalone investment vehicles. While it is true that the growth of the cash value may not match that of more aggressive investments, the cash value provides stability, guaranteed returns, and potential tax advantages.

The cash value can be accessed during your lifetime and used for various purposes, such as supplementing retirement income or funding education expenses. It also offers the opportunity for policy loans that can provide liquidity during times of financial need. The cash value component of whole life insurance provides a unique combination of insurance protection and long-term savings.

Myth: Whole Life Insurance is Complicated

Whole life insurance is often perceived as complex and difficult to understand. While it is true that whole life insurance has more intricate features compared to term life insurance, it can be easily comprehended with proper education and guidance.

By taking the time to review policy documents, ask questions, and seek advice from licensed insurance agents or financial advisors, individuals can gain a clear understanding of how whole life insurance works and the potential benefits it offers. Thoroughly researching and exploring the details of whole life insurance can help dispel the myth of complexity.

Myth: Whole Life Insurance is Only for the Wealthy

Some individuals believe that whole life insurance is only suitable for the wealthy. While it is true that whole life insurance premiums are typically higher compared to term life insurance, it can still be a valuable option for individuals with various income levels.

Whole life insurance can provide lifelong coverage, potential financial benefits, and serve as a tool for estate planning, regardless of income level. It is important to evaluate your financial goals, budget, and coverage needs to determine if whole life insurance aligns with your individual circumstances.

Tips for Choosing the Right Whole Life Insurance Policy

Choosing the right whole life insurance policy is a significant decision that requires careful consideration. By following these tips, you can navigate the process and select a policy that aligns with your financial goals and provides the protection you need.

Assess Your Financial Needs

Evaluate your financial needs and determine what you want to achieve with whole life insurance. Consider your long-term goals, such as providing for your family's financial security, funding education expenses, or leaving a legacy for future generations. Understanding your financial needs will help you determine the appropriate coverage amount and policy features.

Evaluate the Insurance Company

Research and evaluate the insurance company offering the whole life insurance policy. Look for companies with strong financial ratings, as this indicates their ability to meet policyholder obligations and provide long-term stability. Consider factors such as the company's reputation, customer service, and track record.

Review Policy Terms and Features

Thoroughly review the policy terms and features to understand the specifics of the policy. Pay attention to elements such as the death benefit, premium payment schedule, cash value growth rate, and any potential riders or additional benefits included. Ensure that the policy aligns with your needs and objectives.

Consider Premium Affordability

Assess your budget and determine if you can comfortably afford the premiums throughout the life of the policy. Consider your income, expenses, and any other financial obligations you have. Evaluate how the premiums fit within your budget and ensure that they are sustainable over the long term.

Seek Professional Advice

Consult with a licensed insurance agent or financial advisor to gain insights and guidance on choosing the right whole life insurance policy. They can help evaluate your needs, explain policy details, and provide recommendations based on your individual circumstances. Professional advice can help ensure that you make an informed decision and select a policy that aligns with your financial goals.

Compare Multiple Quotes

Obtain quotes from multiple insurance companies to compare policy features and premiums. By comparing quotes, you can ensure that you are getting a policy that offers competitive terms and aligns with your needs. Consider factors such as coverage amount, premium affordability, and potential benefits when comparing quotes.

Read and Understand the Policy Documents

Thoroughly read and understand the policy documents before making a final decision. Take the time to review the terms and conditions, including any exclusions or limitations. If there are any areas of confusion, seek clarification from the insurance company or a professional advisor. Understanding the policy documents will help you make an informed decision and avoid any surprises in the future.

Periodically Review and Update the Policy

Once you have chosen a whole life insurance policy, periodically review and reassess your coverage to ensure it continues to meet your needs. Life circumstances and financial goals can change over time, and it is important to update the policy accordingly. Consider conducting policy reviews every few years or when significant life events occur, such as marriage, the birth of a child, or career changes.

By following these tips, you can navigate the process of choosing the right whole life insurance policy and make an informed decision that aligns with your financial goals. Remember to take your time, ask questions, and seek professional advice when needed.

In Conclusion

Whole life insurance offers lifelong coverage and potential financial benefits, but it also comes with higher premiums and limited flexibility. Understanding the advantages and disadvantages of this type of insurance is crucial in making an informed decision that aligns with your unique financial goals and circumstances.

By exploring the comprehensive information provided in this guide, you can confidently assess whether whole life insurance is the right choice for you. Consider your financial needs, evaluate the benefits and drawbacks, and seek professional advice as needed. With careful consideration and research, you can select a whole life insurance policy that provides the protection and potential financial advantages you desire.

Posting Komentar untuk "Exploring the Pros and Cons of Whole Life Insurance: A Comprehensive Guide"